UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

Landsea Homes Corp.

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

| 2022 |

| NOTICE OF ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

DATE AND TIME |

|

WHO CAN VOTE | |

|

LOCATION |

| VOTING ITEMS | |||

| PROPOSALS | BOARD VOTE RECOMMENDATION | FOR FURTHER DETAILS | |

| 1. | Election of nine directors named in this proxy statement | “FOR” each director nominee | Page 17 |

| 2. | Advisory vote to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2022 | “FOR” | Page 23 |

Stockholders will also transact any other business that may be properly presented at the 2022 Annual Meeting of Stockholders (the “Annual Meeting”). This proxy statement for the Annual Meeting (the “Proxy Statement”) and proxy card or Notice of Internet Availability of Proxy Materials (the “Notice”) is first being made available to our stockholders on April 26 2022.

In support of the health and safety of our stockholders, employees and our Board, we are holding the Annual Meeting in a virtual-only format this year. To attend the Annual Meeting online, vote, submit questions or view the list of registered stockholders during the meeting, stockholders of record will need to go to the meeting website listed above and log in using their 16-digit control number included on their proxy card or Notice. Beneficial owners should review these proxy materials and their voting instruction form or Notice for how to vote in advance of and how to participate in the Annual Meeting.

In the event of a technical malfunction or other situation that the meeting chair determines may affect the ability of the Annual Meeting to satisfy the requirements for a meeting of stockholders to be held by means of remote communication under the Delaware General Corporation Law, or that otherwise makes it advisable to adjourn the Annual Meeting, the chair or secretary of the Annual Meeting will convene the meeting at 9:30 a.m. Pacific Time on the date specified above and at the Company’s address specified below solely for the purpose of adjourning the meeting to reconvene at a date, time and physical or virtual location announced by the meeting chair. Under either of the foregoing circumstances, we will post information regarding the announcement on the Investors page of the Company’s website at https://ir.landseahomes.com.

We encourage you to review these proxy materials and vote your shares before the Annual Meeting.

By Order of the Board of Directors,

FRANCO TENERELLI

Executive Vice President, Chief Legal Officer and Secretary

660 Newport Center Drive, Suite 300

Newport Beach, California 92660

April 26, 2022

| HOW TO VOTE | |||

|

|

|

|

|

INTERNET |

TELEPHONE |

MAIL |

QR CODE |

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF The notice, Proxy Statement and Annual Report (as defined below) are available at www.proxyvote.com. | |||

| 2022 Proxy Statement | 1 |

| NOTICE OF ANNUAL MEETING OF STOCKHOLDERS | 1 | ||

| PROXY STATEMENT SUMMARY | 3 | ||

| CORPORATE GOVERNANCE | 6 | ||

| Business Combination and Corporate Structure | 6 | ||

| Stockholder’s Agreement | 6 | ||

| Director Independence | 7 | ||

| Board Leadership Structure | 8 | ||

| Director Nominations | 9 | ||

| Board Committees | 11 | ||

| Risk Oversight | 14 | ||

| Communications with Directors | 14 | ||

| Governance Documents | 14 | ||

| Insider Trading Policy | 14 | ||

| Director Compensation | 15 | ||

|

PROPOSAL 1: ELECTION OF DIRECTORS | 17 | |

| Director Nominees | 17 | ||

| SUSTAINABILITY AND HUMAN CAPITAL | 22 | ||

| Sustainability in Our Business | 22 | ||

| Human Capital Management | 22 | ||

|

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 23 | |

| Independent Public Accountant | 23 | ||

| Pre-Approval Policy | 24 | ||

| Prior Independent Registered Public Accounting Firm | 24 | ||

| Audit Committee Report | 24 | ||

| INFORMATION ABOUT OUR EXECUTIVE OFFICERS | 25 | ||

| Number and Terms of Office of Officers | 25 | ||

| EXECUTIVE COMPENSATION | 26 | ||

| LFAC | 26 | ||

| Landsea Homes | 26 | ||

| Summary Compensation Table | 27 | ||

| Narrative Disclosure to the Summary Compensation Table | 27 | ||

| Outstanding Equity Awards at Fiscal Year-End | 30 | ||

| Additional Narrative Disclosure | 30 | ||

| EQUITY COMPENSATION PLAN INFORMATION | 32 | ||

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | 33 | ||

| Policies and Procedures for the Company’s Related Person Transactions | 33 | ||

| Related Party Transactions | 33 | ||

| BENEFICIAL OWNERSHIP OF SECURITIES | 38 | ||

| QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING | 40 | ||

| OTHER MATTERS | 43 |

| INDEX OF FREQUENTLY REQUESTED INFORMATION |

||

| Board Leadership Structure | 7 | |

| Board Committees | 9 | |

| Director Compensation | 14 | |

| Director Independence | 7 | |

| Director Nominees | 15 | |

| Employment Agreements | 30 | |

| Governance Documents | 13 | |

| Human Capital Management | 21 | |

| Related Person Transaction Policy | 33 | |

| Risk Oversight | 13 | |

| Sustainability in Our Business | 21 |

| FORWARD-LOOKING STATEMENTS AND WEBSITE REFERENCES |

||

|

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical or current facts, including statements regarding our environmental and other sustainability plans and goals, made in this document are forward-looking. We use words such as anticipates, believes, expects, future, intends, and similar expressions to identify forward-looking statements. Forward-looking statements reflect management’s current expectations and are inherently uncertain. Actual results could differ materially for a variety of reasons. Risks and uncertainties that could cause our actual results to differ significantly from management’s expectations are described in our Annual Report for the year ended December 31, 2021 on Form 10-K (together with our Amendment No. 1 to the Annual Report for the year ended December 31, 2021 on Form 10-K/A, the “Annual Report”). Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document. |

| 2 | Landsea Homes |

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

|

|

|

| DATE AND TIME | LOCATION | RECORD DATE |

| June 8, 2022 at 9:00 a.m. | Online at | April 11, 2022 |

| Pacific Time | www.virtualshareholdermeeting.com/LSEA2022 |

| VOTING MATTERS | BOARD’S VOTE RECOMMENDATIONS | FOR FURTHER INFORMATION | |||

| PROPOSAL 1 | Election of nine directors named in this proxy statement | “FOR” each director nominee | Page 17 | ||

| PROPOSAL 2 | Advisory vote to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2022 | “FOR” | Page 23 | ||

Company Overview and Business Strategy

We are a rapidly growing homebuilder focused on providing High Performance Homes that deliver energy efficient living in highly attractive geographies. Headquartered in Newport Beach, California, we primarily engage in the design, construction, marketing and sale of suburban and urban single-family detached and attached homes in California, Arizona, Florida, Texas and Metro New York. While we offer a wide range of housing options, we primarily focus on entry-level and first-time move-up homes and believe our markets are characterized by attractive long-term housing fundamentals.

We design and build homes and communities that reflect modern living–inspired spaces and features built in vibrant, prime locations where they connect seamlessly with their surroundings and enhance the local lifestyle for living, working and playing. Our defining principle, “Live in your element,” creates the foundation for our customers to live where they want to live and how they want to live in a home created especially for them. Drawing on new home innovation and technology, including a partnership with a leading technology company, we are focused on sustainable, energy-efficient and environmentally friendly building practices that result in a lighter environmental impact, lower resource consumption and a reduced carbon footprint. The four pillars of our High Performance Homes platform are home automation, energy efficiency, sustainability, and enabling a healthy lifestyle. These pillars are reflected in such features as WiFi mesh networking, smart light switches, smart door locks, smart thermostats, WiFi garage door openers, LED lighting, premium air purifiers, and upgraded insulation. Our efficient home designs help reduce lumber, concrete, and building material waste on our jobsites. We are committed to achieving among the highest standards in design, quality and customer satisfaction and are a leader among our peers on several key operating and homebuilding metrics.

Our communities are positioned in attractive markets like Arizona, California, Florida, and Texas, characterized by conditions like high in-migration, low new home supply levels, and high levels of employment. We are also prudently evaluating opportunities in new regional markets in which there is high demand and favorable population and employment growth as a result of proximity to job centers or primary transportation corridors.

Landsea Homes has been recognized locally and nationally for architecture, interior design, website, digital sales resources and more. Landsea Homes is in the top ratings of similar sized homebuilders nationally for positive customer experience in Eliant Homebuyers’ survey.

While we have construction expertise across a wide array of product offerings, we are focused on entry-level and first-time move-up homes. Additionally, we believe our high concentration in entry-level homes helps position us to meet changing market conditions and to optimize returns while strategically reducing portfolio risk. In addition, our attached and higher density products in certain markets enables us to keep our entry-level price point “attainable” and within reach of more new homebuyers. We believe that bringing attainable housing product helps to offset rising land and home costs and supports our expansion into densely populated markets.

| 2022 Proxy Statement | 3 |

Proxy Statement Summary

Directors

The following provides summary information about each current director. Messrs. Chang and Reed will not be standing for re-election at the Annual Meeting, and effective at the Annual Meeting, the size of the board will be reduced to nine. All other directors have been nominated or re-nominated for election or re-election to the Board.

| NAME AND OCCUPATION | AGE | OTHER PUBLIC BOARDS |

COMMITTEE MEMBERSHIPS | |||||||||

| AC | CC | NGC | ELC | |||||||||

|

MING (MARTIN) TIAN |

61 | 3 |

|

|||||||||

|

JOHN HO |

39 | 0 |

|

| ||||||||

|

QIN (JOANNA) ZHOU |

48 | 1 |

|

|

| |||||||

|

BRUCE FRANK IND |

68 | 4 |

✚ ✚ |

|

|

|||||||

|

THOMAS HARTFIELD IND |

69 | 0 |

|

|

| |||||||

|

ROBERT MILLER IND |

57 | 0 |

|

|

|

|||||||

|

SCOTT REED |

52 | 3 | ||||||||||

|

ELIAS FARHAT IND |

56 | 1 |

|

|||||||||

|

TIM CHANG IND |

56 | 0 |

|

|

||||||||

SUSAN LATTMANN IND |

54 | 1 | ||||||||||

MOLLIE FADULE IND |

39 | 0 | ||||||||||

CC – Compensation Committee

NGC – Nominating and Governance Committee

ELC – Executive Land Committee

IND Independent

|

Chair |

|

Member | |

| ✚ Audit Committee Financial Expert | ||||

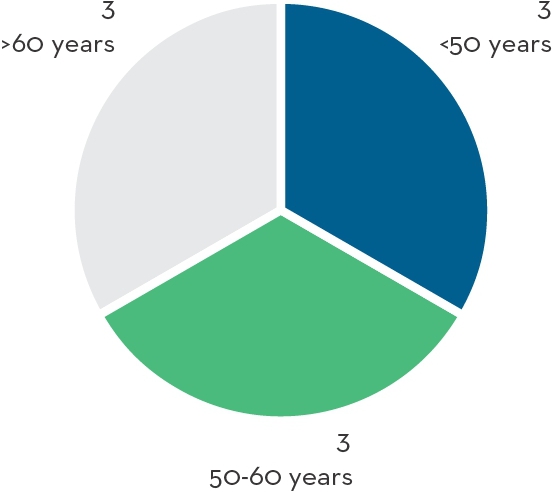

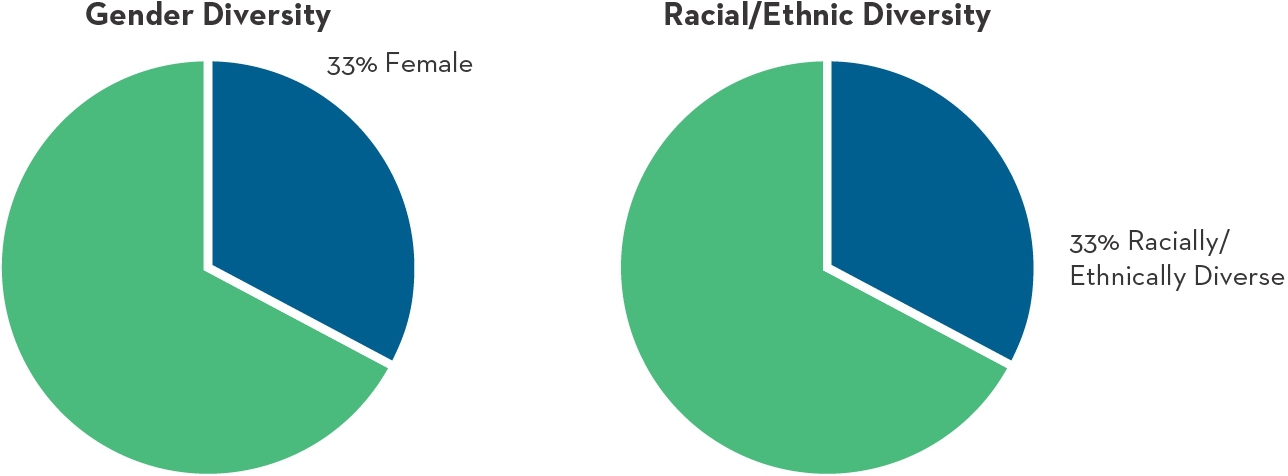

Board Snapshot*

| AGE | DIVERSITY | |||

|

|

|||

| * | Excluding Messrs. Chang and Reed, who will not be standing for re-election at the Annual Meeting. |

| 4 | Landsea Homes |

Proxy Statement Summary

Skills & Experience*

|

Strategic Planning / Strategy Development |

|

9/9 |

|

Human Capital Management |

|

4/9 | |

|

Homebuilding / Real Estate Industry |

|

8/9 |

|

Risk Management |

|

8/9 | |

|

Business Development / Business Operations |

|

6/9 |

|

Public Company Governance |

|

6/9 | |

|

Senior Executive Leadership |

|

8/9 |

|

Legal / Regulatory |

|

2/9 | |

|

Accounting / Financial Reporting |

|

6/9 |

|

Environmental Sustainability Practices |

|

4/9 |

| * | Excluding Messrs. Chang and Reed, who will not be standing for re-election at the Annual Meeting. |

Corporate Governance Highlights

|

●Separated Chairman and CEO roles, with Lead Independent Director

●“Plurality Plus” election standard for directors

●Average director age of 54.5 years |

●Director search process includes women and minorities in the pool (and instructs any engaged search firm to do so)

●Annual Board and committee self-evaluations

●Directors elected annually |

●Annual director evaluations

●No poison pill

●25% special meeting right

|

| 2022 Proxy Statement | 5 |

CORPORATE GOVERNANCE

Business Combination and Corporate Structure

We refer to Landsea Homes Corporation as the “Company,” “us,” “we,” or “our” in this Proxy Statement. As previously disclosed, on January 7, 2021 (the “Closing Date”), the Company, formerly known as LF Capital Acquisition Corp., consummated a business combination (the “Business Combination”) pursuant to which (i) we own, directly and indirectly, 100% of the stock of Landsea Homes Incorporated, a Delaware corporation, which was a private operating company prior to the Business Combination; (ii) Landsea Holdings Corporation, a Delaware corporation (the “Seller”), obtained approximately 71% of our common stock; and (iii) we ceased to be a special purpose acquisition company and changed our name from LF Capital Acquisition Corp. to Landsea Homes Corporation. We refer to the Company prior to the Business Combination as “LFAC” and to the private operating company prior to the Business Combination as “Landsea Homes.”

Stockholder’s Agreement

On the Closing Date, we and the Seller entered into a Stockholder’s Agreement whereby, among other things, the parties agreed to certain rights and obligations of the Company and the Seller with respect to the Company’s corporate governance. On December 21, 2021, we and the Seller agreed to amend the Stockholder’s Agreement with respect to certain provisions.

Board Composition

The Stockholder’s Agreement originally provided that the authorized number of directors for our Board of Directors (the “Board”) be nine. As a result of meeting the highest ownership threshold in the Stockholder’s Agreement, the Seller initially had the right to nominate seven directors to serve on the Board, two of whom had to satisfy the independent director requirements under Nasdaq Stock Market (“Nasdaq”) rules. The Seller designated Messrs. Tian, Ho, Frank, Hartfield, Miller, and Chang and Ms. Zhou to serve as directors following the closing of the Business Combination on January 7, 2021. On December 21, 2021, the Stockholder’s Agreement was amended to provide that the authorized number of directors be 11, and to increase the number of directors designated by the Seller by one director for so long as the Combined Ownership Percentage (as defined in the Stockholder’s Agreement) was greater than 39%.

On April 25, 2022, the Stockholder’s Agreement was again amended to provide that the authorized number of directors be nine. As amended, the Stockholder’s Agreement provides that the Seller shall have the right to nominate for election to the Board the following number of directors for so long as its Combined Ownership Percentage (as defined in the Stockholder’s Agreement) is equal to or greater than the percentage indicated in the left hand column of the table below:

| COMBINED OWNERSHIP PERCENTAGE | DIRECTOR DESIGNEES | |

| 50% plus one share | 7 | |

| 39% | 4 | |

| 28% | 3 | |

| 17% | 2 | |

| 6% | 1 |

In the event a decrease in the Combined Ownership Percentage reduces the number of director designees the Seller is entitled to nominate, the number of director designees of the Seller shall be reduced in accordance with the table set forth above.

The Stockholder’s Agreement provided that the Company initially designate Ming (Martin) Tian as Chairman of the Board.

| 6 | Landsea Homes |

Corporate Governance

Board Committees

The Stockholder’s Agreement provides that the Board establish and maintain: (i) a Compensation Committee; (ii) a Nominating and Governance Committee; and (iii) an Audit Committee. The Compensation Committee and Nominating and Governance Committee must each consist of at least five directors, two of whom shall be independent under Nasdaq rules (including those applicable to such committees). The Audit Committee must consist of three independent directors under Nasdaq rules (including those applicable to such committees).

For so long as the Combined Ownership Percentage is equal to or greater than 15%, each of the standing committees will include at least one director designee (or more than one, at the Seller’s discretion, if the Seller is entitled to designate more than one director designee), subject to applicable Nasdaq rules.

Director Independence

Our Board has determined that Mses. Fadule and Lattmann and Messrs. Frank, Hartfield, Miller, Chang and Farhat are independent within the meaning of Nasdaq Listing Rule 5605(a)(2). In making these independence determinations, our Board has reviewed and discussed information provided by the directors to us with regard to each director’s business and personal activities and relationships as they may relate to us and our management, including Mr. Farhat’s beneficial ownership of 9.5% of the Company, including 2,227,835 shares of the Company’s Common Stock and 2,799,600 private placement warrants by virtue of his relationship to the Sponsor, Level Field Capital, LLC, of which Mr. Farhat is a co-managing member.

Under the Nasdaq listing rules and applicable SEC rules, we are required to have at least three members of the audit committee, all of whom must be independent. In addition to determining whether each director satisfies the director independence requirements set forth in the Nasdaq listing rules, in the case of members of the Audit Committee, our Board has also made an affirmative determination that each of the current members of the Audit Committee, Messrs. Frank, Farhat and Miller, satisfy separate independence requirements under the SEC rules for such members.

The Compensation Committee comprises at least five directors, with at least two directors meeting Nasdaq independence requirements, and otherwise meets Nasdaq compensation committee composition requirements as provided for in the Stockholder’s Agreement. Pursuant to the Nasdaq listing rules, as a “controlled company,” we are not required to have a compensation committee composed entirely of independent directors; however, at such time as we cease to qualify as a “controlled company” under the Nasdaq rules, each member of the Compensation Committee will satisfy Nasdaq’s independence requirements, subject to any applicable transition periods.

Controlled Company Exception

The Seller beneficially owns a majority of the voting power of all outstanding shares of the Company’s common stock, making us a “controlled company.” Pursuant to Nasdaq listing rules, a “controlled company” may elect not to comply with certain Nasdaq listing rules that would otherwise require it to have: (i) a board of directors comprised of a majority of independent directors; (ii) compensation of our executive officers determined by a majority of the independent directors or a compensation committee comprised solely of independent directors; (iii) a compensation committee charter which, among other things, provides the compensation committee with the authority and funding to retain compensation consultants and other advisors; and (iv) director nominees selected, or recommended for the board’s selection, either by a majority of the independent directors or a nominating committee comprised solely of independent directors. We currently rely on the exemptions described in clauses (i), (ii) and (iv) above. Accordingly, the Company’s stockholders do not have the same protections afforded to stockholders of companies that are subject to all of the Nasdaq corporate governance requirements. In the event that we cease to be a “controlled company” and our shares continue to be listed on the Nasdaq, we will be required to comply with these provisions within the applicable transition periods.

| 2022 Proxy Statement | 7 |

Corporate Governance

Board Leadership Structure

The Board annually reviews its leadership structure to evaluate whether the structure remains appropriate for the Company. The Board selects its Chairman and the Chief Executive Officer (the “CEO”) in a way it considers in the best interests of the Company. The Board does not have a policy on whether the role of Chairman and CEO should be separate or combined. The Board has determined, however, that wherever and for so long as the Chairman is not an independent director, then there shall also be a lead independent director.

Currently, our Chairman is Ming (Martin) Tian, and the Lead Independent Director is Bruce Frank.

Lead Independent Director

The Lead Independent Director’s responsibilities include the following:

| ● | presiding at meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors; |

| ● | coordinating feedback to the Chairman and the CEO regarding matters discussed in executive session; |

| ● | approving information sent to the Board; |

| ● | approving the agenda and schedule for Board meetings to provide that there is sufficient time for discussion of all agenda items; |

| ● | serving as liaison between the Chairman, the CEO and the independent directors; |

| ● | assisting the Board and Company officers in promoting compliance with and implementation of the Guidelines and providing key inputs to Board governance structures and practices; |

| ● | providing oversight of CEO and Chairman succession; |

| ● | providing advice and counsel to the CEO and other senior management and serving as an informational resource for other directors; |

| ● | interviewing director candidates; |

| ● | together with the Chairman and the chairpersons of the Committees, coordinating self-evaluations of the Board, its Committees, and the individual directors; |

| ● |

being available for consultation and communication with major stockholders upon request; |

| ● | acting as spokesperson for the Board where it is appropriate for the Board to have a voice distinct from that of management, as requested by the CEO; |

| ● | together with the Chairman, providing leadership to the Board in the establishment of positions the Board takes on issues to be voted on by stockholders; and |

| ● | reinforcing the tone at the top. |

In addition, the Lead Independent Director also has the authority to call executive sessions or meetings of the independent directors and special meetings of the Board.

| 8 | Landsea Homes |

Corporate Governance

Director Nominations

In accordance with its charter, the Nominating and Governance Committee develops and recommends to the Board skills, experience, characteristics and other criteria for identifying and evaluating directors. These will inform the committee’s annual evaluation of the Board’s composition assess the mix of skills, experience, characteristics and other criteria that are currently represented on the Board and those that may be needed in the future. The Board and the Nominating and Governance Committee also actively seek to achieve a diversity of occupational and personal backgrounds on the Board, including diversity with respect to demographics such as gender, race, ethnic and national background, geography, age and sexual orientation. As part of the search process for each new director, the Nominating and Governance Committee includes women and minorities in the pool of candidates (and instructs any search firm the Committee engages to do so).

We have not formally established any specific, minimum qualifications that must be met or skills that are necessary for directors to possess. The Nominating and Governance Committee reviews the qualifications of director candidates and incumbent directors in light of the criteria approved by Board, and any stockholder recommendations for director are evaluated in the same manner as other candidates considered by the Nominating and Governance Committee. Stockholders that wish to nominate a director for election to our Board should follow the procedures described under the “Submission of Stockholder Proposals for the 2023 Annual Meeting” heading. Pursuant to the Stockholder’s Agreement, as amended, the Seller is currently entitled to designate 7 directors.

The following describes the skills, experience, characteristics and other criteria identified by the Nominating and Governance Committee as desirable for the Board in light of its current business:

|

Strategic

Planning / Strategy Development |

Experience defining and driving the strategic direction and growth, and managing the operations of, a business (including large organizations). |

|

Homebuilding

/ Real Estate Industry |

Experience in the residential homebuilding sector, where the purchase and development of real estate is integral to the business. |

|

Business Development / Business Operations |

Experience developing and implementing business plans and strategy and a deep understanding of our operations, key performance indicators and competitive environment. |

|

Senior

Executive Leadership |

Experience serving as a senior executive, as well as hands-on leadership in core management areas, such as strategic and operational planning, financial reporting, compliance, risk management and leadership planning, which provides a practical understanding of how organizations like the Company function. |

|

Accounting

/ Financial Reporting |

Ability to monitor and assess the Company’s operating and strategic performance and to support accurate financial reporting and robust controls with relevant background and experience in debt and capital markets, corporate finance, mergers and acquisitions, accounting and financial reporting. |

|

Human

Capital Management |

Experience managing or developing a large and diverse workforce. |

|

Risk Management | Experience managing and mitigating key risks, including cybersecurity, regulatory compliance, competition, financial, brand integrity and intellectual property risks. |

|

Public

Company Governance |

An understanding of corporate governance practices and trends and insights into board management, relations between the board, the CEO and senior management, agenda setting and succession planning from service on other public company boards and board committees. |

|

Legal / Regulatory | Experience with government relations, regulatory matters or regulated industries and political affairs, which provides insight and perspective in working constructively and proactively with governments and agencies globally. |

|

Environmental Sustainability Practices |

Experience supporting or overseeing improvements in the environmental performance, and reducing the potential impacts of, a business and its products and/or operations. |

| 2022 Proxy Statement | 9 |

Corporate Governance

The following chart shows how these skills, experience, characteristics and other criteria will be represented on the Board following the Annual Meeting, if each director nominee is elected. This chart is not intended to be an exhaustive list for each director nominee, but instead intentionally focuses on the primary skillsets each director nominee contributes. Information populated in this chart has been derived from director nominee’s responses to their most recently completed director and officer questionnaire and existing public disclosures.

| FADULE | FARHAT | FRANK | HARTFIELD | HO | LATTMAN | MILLER | TIAN | ZHOU | |

| Strategic Planning / Strategy Development | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ |

| Homebuilding / Real Estate Industry | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | |

| Business Development / Business Operations | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | |||

| Senior Executive Leadership | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | |

| Accounting / Financial Reporting | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | |||

| Human Capital Management | ⚫ | ⚫ | ⚫ | ⚫ | |||||

| Risk Management | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | |

| Public Company Governance | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | |||

| Legal / Regulatory | ⚫ | ⚫ | |||||||

| Environmental Sustainability Practices | ⚫ | ⚫ | ⚫ | ⚫ | |||||

| Diversity (Gender) | F | M | M | M | M | F | M | M | F |

| Diversity (Race/Ethnicity) | ⚫ | ⚫ | ⚫ |

The following chart additionally sets forth the board diversity information required by Nasdaq for all of our current directors:

| BOARD DIVERSITY MATRIX (AS OF APRIL 26, 2022) | |||||

| Total Number of Directors | 11 | ||||

| FEMALE | MALE | NON-BINARY | DID NOT DISCLOSE GENDER | ||

| Part I: Gender Identity | |||||

| Directors | 3 | 8 | |||

| Part II: Demographic Background | |||||

| African American or Black | |||||

| Alaskan Native or Native American | |||||

| Asian | 1 | 3 | |||

| Hispanic or Latinx | |||||

| Native Hawaiian or Pacific Islander | |||||

| White | 2 | 5 | |||

| Two or More Races or Ethnic | |||||

| LGBTQIA+ | – | ||||

| Did Not Disclose Demographic Background | – | ||||

| 10 | Landsea Homes |

Corporate Governance

Board Committees

Our Board has four standing committees: an Audit Committee, a Compensation Committee, a Nominating and Governance Committee and an Executive Land Committee.

In accordance with our Corporate Governance Guidelines, the independent directors meet in executive session without management present at least quarterly.

During the fiscal year ended December 31, 2021, the Board held 7 meetings, the Audit Committee held 11 meetings, the Compensation Committee held 4 meetings and the Nominating and Governance Committee held 4 meetings. In 2021, all directors attended at least 75% of the meetings of the Board, and of each committee of which they were a member, during the time in which they served as a member the board and as a member of each committee, respectively.

Directors are expected to attend the annual meeting of stockholders absent unusual circumstances. In 2021, all nine members of the Board attended our annual meeting.

| AUDIT COMMITTEE | |

|

MEMBERS |

PRINCIPAL RESPONSIBILITIES: We have adopted a committee charter that details the principal functions of the Audit Committee, including: ●the appointment, compensation, retention, replacement, and oversight of the work of the independent auditors and any other independent registered public accounting firm engaged by us;

●obtaining and reviewing a report, at least annually, from the independent auditors describing (i) the independent auditors’ internal quality-control procedures and (ii) any material issues raised by the most recent internal quality-control review, or peer review, of the audit firm, or by any inquiry or investigation by governmental or professional authorities within the preceding five years respecting one or more independent audits carried out by the independent auditor and any steps taken to deal with such issues;

●pre-approving all audit and permissible non-audit services to be provided by the independent auditors or any other registered public accounting firm engaged by us, and establishing pre-approval policies and procedures;

●reviewing and discussing with the independent auditors all relationships the auditors have with us in order to evaluate their continued independence;

●reviewing and discussing with management and the independent auditor our annual audited and quarterly financial statements, including management’s discussion and analysis of financial condition and operations and the independent auditor’s reports related to the financial statements;

●receiving reports from management and the independent auditors on, and review and discuss the adequacy and effectiveness of, our internal controls and disclosure controls;

●establishing hiring policies for employees and former employees of the independent auditors;

●establishing and periodically reviewing policies and procedures for the review, approval and ratification of related person transactions, as defined in applicable SEC rules, review related person transactions, and oversee other related person transactions governed by applicable accounting standards; and

●annually evaluating the performance of the Audit Committee and assessing the adequacy of the Audit Committee’s charter.

Under the Nasdaq listing rules and applicable SEC rules, we are required to have at least three members of the audit committee, all of whom must be independent. Each member of the Audit Committee is financially literate, and our Board has determined that Mr. Frank qualifies as an “audit committee financial expert” as defined in applicable SEC rules and has accounting or related financial management expertise. The Audit Committee has established and oversees procedures for handling reports of potential misconduct, and whereby complaints or concerns regarding accounting, internal accounting controls, auditing or federal securities law matters may be submitted anonymously to the Audit Committee. The Audit Committee has the authority to retain counsel and other advisers as it determines appropriate to assist in performance of its functions at our expense. |

| 2022 Proxy Statement | 11 |

Corporate Governance

| COMPENSATION COMMITTEE | |

|

MEMBERS |

PRINCIPAL RESPONSIBILITIES: The Compensation Committee acts on behalf of and in conjunction with the Board to establish or recommend the compensation of our executive officers and to provide oversight of our overall compensation philosophy, policies and programs. We have adopted a committee charter that details the principal functions of the Compensation Committee, including: ●reviewing and approving on an annual basis the corporate goals and objectives relevant to our CEO’s compensation, evaluating our CEO’s performance in light of such goals and objectives and recommending to the Board for approval the compensation of our CEO’s based on such evaluation;

●overseeing the evaluation of executive officers other than the CEO and reviewing and recommending to the Board for approval on an annual basis the compensation of such other executive officers;

●administering and making recommendation to the Board with respect to our incentive compensation and equity-based remuneration plans that are subject to Board approval;

●approving and amending or modifying the terms of other compensation and benefit plans;

●reviewing and recommending to the Board for approval employment and severance arrangements for our executive officers;

●assisting management in complying with our proxy statement and annual report disclosure requirements, and overseeing preparation of the compensation committee report when required by SEC rules for inclusion in our annual report and proxy statement;

●reviewing, evaluating and recommending changes, if appropriate, to the remuneration for directors; and

●annually evaluating the performance of the Compensation Committee and assessing the adequacy of the Compensation Committee’s charter.

The Compensation Committee may delegate its duties and responsibilities to one or more subcommittees, consisting of not less than two members of the Compensation Committee, as it determines appropriate. The Compensation Committee comprises at least five directors, with at least two directors meeting Nasdaq independence requirements, and otherwise meets Nasdaq compensation committee composition requirements as provided for in the Stockholder’s Agreement. Pursuant to the Nasdaq listing rules, as a “controlled company,” we are not required to have a compensation committee composed entirely of independent directors; however, at such time as we cease to qualify as a “controlled company” under the Nasdaq rules, each member of the Compensation Committee will satisfy Nasdaq’s independence requirements, subject to any applicable transition periods. The Compensation Committee has the authority, in its sole discretion, to retain or obtain the advice of a compensation consultant, legal counsel or other advisers, at our expense, and are directly responsible for the appointment, compensation and oversight of the work of any such advisers. However, before engaging or receiving advice from a compensation consultant, external legal counsel or any other adviser, the Compensation Committee considers the independence of each such adviser, including the factors required by Nasdaq and the SEC. The Landsea Homes Compensation Committee engaged Pearl Meyer in December 2020 to serve as the compensation consultant for the Compensation Committee post-Business Combination and to provide advice in connection with the design of the Company’s 2021 compensation program for directors and executives following the Business Combination. Pearl Meyer did not provide any other services to the Company or management, and Pearl Meyer only received fees from the Company for the services it provided to the Compensation Committee. The Compensation Committee evaluated Pearl Meyer’s independence under the applicable Nasdaq and SEC standards and concluded that Pearl Meyer was independent of the Company and that its services raised no conflicts of interest. The Company’s CEO and President/Chief Operating Officer were invited to participate in discussions regarding the 2021 compensation program and to give their recommendations. |

| * | Mr. Chang is not standing for re-election at the Annual Meeting. |

| 12 | Landsea Homes |

Corporate Governance

| NOMINATING AND GOVERNANCE COMMITTEE | ||

|

MEMBERS

Qin (Joanna) Zhou (Chair) John Ho Bruce Frank Thomas J. Hartfield Robert Miller Tim T. Chang* |

PRINCIPAL RESPONSIBILITIES:

The Nominating and Governance Committee assists the Board by identifying and recommending individuals qualified to become members of the Board. The Nominating and Governance Committee is responsible for evaluating the composition, size and governance of the Board and its committees and making recommendations regarding future planning and the appointment of directors to the committees, establishing procedures for considering stockholder nominees to the Board, reviewing the corporate governance principles and making recommendations to the Board regarding possible changes; and overseeing and monitoring compliance with our Code of Business Conduct and Ethics. We have adopted a committee charter, which details the purpose and responsibilities of the Nominating and Governance Committee, including:

●reviewing and recommending to the Board the skills, experience, characteristics and other criteria for identifying and evaluating directors;

●identifying, reviewing the qualifications of, and recruiting individuals qualified to serve as directors, consistent with criteria approved by the Board, and recommending to our Board candidates for nomination for election at the annual meeting of stockholders or to fill vacancies on our Board;

●developing and recommending to our Board a set of corporate governance guidelines;

●annually reviewing the Board’s leadership structure and recommending changes to the Board as appropriate, and making recommendations to the independent directors regarding the appointment of the lead independent director;

●overseeing succession planning for positions held by senior executive officers and reviewing succession planning and management development at least annually with the Board;

●overseeing the annual self-evaluation of our Board, its committees, and individual directors; and

●annually evaluating the performance of the Nominating and Governance Committee and assessing the adequacy of the Nominating and Governance Committee’s charter.

The Nominating and Governance Committee comprises at least five directors, with at least two directors meeting Nasdaq independence requirements, and otherwise meets the Nasdaq nominating and governance committee composition requirements as provided for in the Stockholder’s Agreement. Pursuant to the Nasdaq listing rules, as a “controlled company,” we are not required to have a nominating and governance committee composed entirely of independent directors; however, at such time as we cease to qualify as a “controlled company” under the Nasdaq rules, each member of the Nominating and Governance Committee will satisfy Nasdaq’s independence requirements, subject to any applicable transition periods. The Nominating and Governance Committee has the authority to retain counsel and other advisers as it determines appropriate to assist in performance of its functions at our expense, including, any search firm to be used to identify director candidates, and to approve the fees and other retention terms of any such advisers. | |

| * | Mr. Chang is not standing for re-election at the Annual Meeting. |

| EXECUTIVE LAND COMMITTEE | ||

|

MEMBERS

Qin (Joanna) Zhou (Chair) John Ho Thomas Hartfield |

PRINCIPAL RESPONSIBILITIES:

The Executive Land Committee reviews and approves certain proposed transactions, including land purchases, borrowings, land sales, and joint ventures. The Executive Land Committee has the authority to retain advisers as it determines appropriate to advise the committee and can set the terms (including approval of fees and expenses) of all such engagements, and to terminate any such engagements, and the Company will provide for appropriate funding, as determined by the committee, for paying fees to such advisors engaged by the committee. | |

| 2022 Proxy Statement | 13 |

Corporate Governance

Risk Oversight

A core responsibility of the Board is to oversee the Company’s processes for assessing and managing risk. While the Audit Committee has primary responsibility for risk oversight, both the Audit Committee and the Board are actively involved in risk oversight and both receive reports on our risk management activities from our executive management team on a regular basis. Members of both the Audit Committee and the Board also engage in periodic discussions with members of management as they deem appropriate to review and address the proper management of the Company’s risks. In addition, each committee of the Board considers risks associated with its respective area of responsibility.

| BOARD | ||||

| Oversees the Company’s processes for assessing and managing risk | ||||

|

|

| ||

|

AUDIT COMMITTEE |

COMPENSATION COMMITTEE |

NOMINATING & | ||

|

●Reviews and discusses the Company’s practices with respect to risk assessment and risk management, and risks related to matters including the Company’s financial statements and financial reporting processes, compliance, and information technology and cybersecurity |

●Oversees the assessment of the risks related to the Company’s compensation policies and programs applicable to officers and employees, and reports to the Board on the results of this assessment |

●Oversees risks related to corporate governance, including succession planning regarding the CEO and members of the Board | ||

|

|

| ||

|

MANAGEMENT | ||||

|

CEO, Chief Accounting Officer, Chief Legal Officer and Chief Operating Officer, and other members of management monitor and implement policies for managing the Company’s risks, including those related to legal, accounting and financial matters, and report periodically on these matters to the Board and its Committees | ||||

Communications with Directors

Stockholders may contact the Board by mailing correspondence “c/o Corporate Secretary” to the Company’s principal offices at 660 Newport Center Drive, Suite 300, Newport Beach, CA 92660. Correspondence will be forwarded to the respective director, except that the Corporate Secretary reserves the right not to forward advertisements or solicitations, customer complaints, obscene or offensive items, communications unrelated to the Company’s affairs, business or governance, or otherwise inappropriate materials.

Governance Documents

The Audit Committee, Compensation Committee, and Nominating and Governance Committee each operate pursuant to written charters adopted by the Board. These charters, along with the Corporate Governance Guidelines and the Code of Business Conduct and Ethics, are available at the Company’s website and in print to any stockholder who requests a copy. To access these documents from the Company’s website, go to ir.landseahomes.com and select “Governance” from the drop-down menu. Requests for a printed copy should be addressed to Corporate Secretary, Landsea Homes Corporation, 660 Newport Center Drive, Suite 300, Newport Beach, CA 92660.

Insider Trading Policy

Our Insider Trading Policy prohibits all directors, officers, and employees, as well as members of such persons’ immediate families and households (other than household employees) and such persons’ controlled entities, from engaging in the following: (a) short-term trading; (b) short sales; and (c) transactions involving publicly traded options or other derivatives, such as trading in puts or calls with respect to Company securities.

| 14 | Landsea Homes |

Corporate Governance

Director Compensation

Landsea Homes entered into a services agreement with each of its non-employee, independent directors, pursuant to which each director is provided a retainer to serve on the Landsea Homes Board and stipends for specific committee service, as described below:

| ● | Annual retainer of $80,000, paid on a monthly basis; and |

| ● | Annual stipend of $30,000, paid on a monthly basis, for service as the chair of Landsea Homes’ Compensation Committee or Audit Committee. |

Effective as of April 1, 2021, members of our Board (other than Mr. Tian) who are not employees of the Company receive the following compensation under our director compensation program. The director compensation program also provides each member of the Board with reimbursement for reasonable travel and miscellaneous expenses incurred in attending meetings and activities of the Board and its committees.

| Annual Cash Retainer: | $ | 70,000 | |

| Committee Chairperson Retainers: | |||

| Audit Committee | $ | 25,000 | |

| Compensation Committee | $ | 20,000 | |

| Nominating and Governance Committee | $ | 20,000 | |

| Executive Land Committee | $ | 10,000 | |

| Committee Membership Retainers: | |||

| Audit Committee | $ | 10,000 | |

| Compensation Committee | $ | 8,000 | |

| Nominating and Governance Committee | $ | 6,000 | |

| Executive Land Committee | $ | 5,000 | |

| Lead Director Retainer: | $ | 20,000 | |

| Value of Annual Equity Grant (RSUs): | $ | 95,000 |

In accordance with the terms of the director compensation program, each member of our Board (other than Mr. Tian) who is not an employee of the Company received a grant of 11,671 RSUs under the Incentive Plan, which vested on January 1, 2022. The following table presents information regarding compensation paid to the Company’s directors during the fiscal year ended December 31, 2021 (the “2021 Fiscal Year”):

| NAME | FEES EARNED OR PAID IN CASH ($)(1) |

STOCK AWARDS ($)(2) |

TOTAL ($) | ||||||

| Tim Chang(3) | $ | 84,516 | $ | 94,652 | $ | 179,168 | |||

| Elias Farhat | $ | 81,518 | $ | 94,652 | $ | 176,170 | |||

| Mollie Fadule(4) | $ | — | $ | — | $ | — | |||

| Bruce Frank | $ | 204,357 | $ | 94,652 | $ | 299,009 | |||

| Thomas Hartfield | $ | 187,105 | $ | 94,652 | $ | 281,757 | |||

| Susan Lattmann(4) | $ | — | $ | — | $ | — | |||

| Robert Miller | $ | 178,105 | $ | 94,652 | $ | 272,757 | |||

| Scott Reed(3) | $ | 74,014 | $ | 94,652 | $ | 168,666 | |||

| Martin Tian | $ | — | $ | — | $ | — | |||

| Joanna Zhou | $ | 104,498 | $ | 94,652 | $ | 199,150 | |||

| (1) | In addition to cash retainers and stipends, amounts in this column for the 2021 Fiscal Year include cash payments and the value of shares (based on the closing price of the shares on the issuance date of $10.53 per share) received in settlement of shares of phantom stock held by Messrs. Frank, Hartfield and Miller which vested and were settled in connection with the Business Combination, as described below. |

| (2) | Amounts in this column represent the aggregate grant date fair value of the restricted stock units (“RSUs”) granted during the 2021 Fiscal Year, calculated in accordance with FASB ASC Topic 718. Please read Note 15 to our consolidated financial statements for the fiscal year ending December 31, 2021 included in our Annual Report for a discussion of the assumptions used to determine the FASB ASC Topic 718 value of the awards. As of December 31, 2021, each non-employee director other than Mr. Tian held 11,671 unvested RSUs. |

| (3) | Messrs. Chang and Reed are not standing for re-election at the Annual Meeting. |

| (4) | Mses. Lattmann and Fadule were appointed to our Board on December 31, 2021 and, as such, did not receive any compensation during the 2021 Fiscal Year. |

| 2022 Proxy Statement | 15 |

Corporate Governance

Each of Messrs. Frank, Hartfield and Miller also received 2.57 shares of phantom stock under the Phantom Stock Plan on January 1, 2020, which were scheduled to vest on March 1, 2023, subject to each director’s continued service to Landsea Homes through such date. As described below under “Executive Compensation—Narrative Disclosure to the Summary Compensation Table—Long Term Incentive Compensation,” each share of phantom stock, including those held by the non-employee directors, became fully vested in connection with the Business Combination. Additionally, the non-employee directors received settlement of their phantom equity awards in a combination of cash and shares of Common Stock. The following table sets forth the cash and Common Stock received by each non-employee director in connection with the Business Combination.

| NAME | NUMBER OF SHARES OF PHANTOM EQUITY |

SETTLEMENT UPON THE BUSINESS COMBINATION | ||||

| CASH PAYMENT | NUMBER OF SHARES OF COMMON STOCK | |||||

| Bruce Frank | 7.85 | $24,786.71 | 5,491 | |||

| Thomas Hartfield | 7.85 | $24,786.71 | 5,491 | |||

| Robert Miller | 7.85 | $24,786.71 | 5,491 | |||

| 16 | Landsea Homes |

| PROPOSAL 1 | ||

|

Election of Directors

Our Second Amended and Restated Certificate of Incorporation (the “Certificate”) specifies that the Board consists of one class of directors. Based on the recommendation of the Nominating and Governance Committee, the Board nominated nine directors for election at the Annual Meeting to hold office until the next annual meeting of our stockholders and until their successors have been elected and qualified. Each of the nominees has consented to serve as a director, if elected, and all of the nominees are currently directors. We have no reason to believe that any of the nominees will be unavailable or, if elected, will decline to serve. If any nominee becomes unable or unwilling to stand for election as a director, proxies will be voted for any substitute as designated by the Board, or alternatively, the Board may reduce the size of the Board. |

||

|

Our Board recommends a vote “FOR” the election of each nominee. |

Director Nominees

For each of the nine director nominees standing for election, the following describes certain biographical information and the specific experience, qualifications, attributes or skills that qualify them to serve as our directors and, as applicable, the Board committees on which they serve.

|

COMMITTEES |

OTHER PUBLIC COMPANY BOARDS |

|

●Compensation |

●Landsea Green

●Landsea Green Life Service Company Limited (“Landsea Green Life Service”)

●Chervon Holdings Co., Ltd. |

|

BACKGROUND |

|

|

●Served on the board of directors of Landsea Homes (the “Landsea Homes Board”) from 2013 until the Business Combination.

●Founded the former ultimate parent company of Landsea Homes, Landsea Group Co., Ltd. (“Landsea Group”), a real estate developer and operator of green tech companies, in 2001 in China, and is now Landsea Group’s largest stockholder.

●Has served as chairman and president of Landsea Group and one of its subsidiaries, Landsea Green, an international property development service provider with green building technologies and vertically integrated business capabilities, since 2001.

●Under Mr. Tian’s leadership, Landsea Group’s assets have grown from a registered capital investment of $1.5 million (at incorporation) to a total asset value exceeding $4.7 billion. |

●Is Non-Executive Director and Chairman of the Board of Landsea Green Life Service.

●Has served as president and chairman of Seller since 2015, and is chairman of private company Shanghai Landleaf Architecture Technology Co., Ltd.

●Is Independent Director of Chervon Holdings Co., Ltd. (“Chervon”), a provider of power tools and outdoor power equipment.

●Received a master’s degree from the Nanjing University in Foreign-Related Economic Administration and a master’s degree in EMBA from China Europe International Business School in Shanghai, China. |

Mr. Tian was selected to serve on our Board due to his significant leadership experience and his extensive global management and investment experience, including in the real estate sector.

| 2022 Proxy Statement | 17 |

Proposal 1 Election of Directors

|

COMMITTEES |

OTHER PUBLIC COMPANY BOARDS |

|

●Nominating and Governance

●Executive Land |

None |

|

BACKGROUND |

|

|

●Established Landsea Homes in August 2013 and served as its CEO and board member from 2014 until the Business Combination.

●Has served as CEO of the Company since the Business Combination and served as interim Chief Financial Officer of the Company from the Business Combination until December 2021.

●Served as interim Chief Financial Officer of Landsea Homes from January 2019 until the Business Combination.

●Prior to forming Landsea Homes, spent 10 years in real estate investment and development with a focus on cross-border transactions between the U.S. and China working at global real estate investment management and consulting firms Colliers International and Jones Lang LaSalle (“JLL”). |

●Served as Director of JLL from July 2011 to October 2013, and Vice President at JLL from December 2008 to June 2011. During that time, he led the firm in cross-border business development, focused on delivering transactional, consultancy and other integrated real estate services to outbound Chinese businesses investing overseas.

●Served as a director of the Seller from 2014 to January 2021.

●Received a bachelor’s degree from the University of Southern California and an MBA from the UCLA Anderson School of Management. |

Mr. Ho was selected to serve on our Board due to his extensive leadership experience within the real estate industry, his financial management expertise, his experience growing the workforce for Landsea Homes, and his experience operating the Company for the past eight years. Under Mr. Ho’s leadership, Landsea Homes has grown from a start up operation with no revenue in 2013 into a 250+ employee business with north of $700 million in revenues in 2020 despite numerous challenges and the pandemic.

|

COMMITTEES |

OTHER PUBLIC COMPANY BOARDS |

|

●Compensation

●Nominating and Governance (Chair)

●Executive Land (Chair) |

●Landsea Green Life Service |

|

BACKGROUND |

|

|

●Served on the Landsea Homes Board from 2013 until the Business Combination.

●CEO and director of the Seller since January 2021.

●Has over 21 years of experience in business development, investment and operational management in real estate.

●Joined Landsea Green in 2002 and served as the regional general manager in multiple locations, such as Nanjing, Suzhou and Shanghai. Ms. Zhou retired by rotation from Landsea Green effective June 19, 2020 to focus on the business efforts of Landsea Group, the controlling stockholder of Landsea Green.

●Served as non-executive director for Landsea Green from January 2015 to August 2016, when she was redesigned as an executive director. |

●Previously led Landsea Group’s global strategic deployment while serving as the assistant to the chairman, general manager of Shanghai Landsea Architecture Technology Co., Ltd. and general manager of Landsea Architecture Design Institute. Ms. Zhou also served as the Chief Human Resource Officer of Landsea Group, and has served as vice president of Landsea Group since 2015.

●Is Executive Director and Vice Chairwoman of the Board of Landsea Green Life Service.

●Received an Executive MBA from China Europe International Business School and an MBA from Nanjing University. |

Ms. Zhou was selected to serve on our Board due to her extensive experience and knowledge in the real estate industry, including as an executive of the Seller, and her service as a member of the Landsea Homes Board. Ms. Zhou played a fundamental role in facilitating Landsea Group’s U.S. business development and investment in Landsea Homes.

| 18 | Landsea Homes |

Proposal 1 Election of Directors

|

COMMITTEES |

OTHER PUBLIC COMPANY BOARDS |

|

●Audit (Chair)

●Compensation

●Nominating and Governance |

●Morgan Stanley Direct Lending Fund

●SL Investment Corp.

●T Series Middle Market Loan Fund LLC

●North Haven Private Income Fund LLC |

|

BACKGROUND |

|

|

●Served on the Landsea Homes Board from 2015 until the Business Combination.

●Served as a senior partner within the assurance service line of Ernst & Young LLP’s real estate practice from April 1997 to June 2014, when he retired.

●Chairs the Audit Committees of Morgan Stanley Direct Lending Fund, SL Investment Corp., T Series Middle Market Loan Fund LLC, and North Haven Private Income Fund LLC. |

●Served as a member of the board of directors of VEREIT, Inc. from July 2014 through March 2017 and was a member of its Audit and Nominating and Corporate Governance Committees.

●Served as a member of the board of directors of ACRE Realty Investors Inc. from October 2014 through October 2017 and was a member of its Audit and Compensation Committees.

●Earned a bachelor’s degree from Bentley College. |

Mr. Frank is a member of the American Institute of Certified Public Accountants and is a Certified Public Accountant in the State of New York. Mr. Frank was selected to serve on our Board due to his more than 35 years’ experience in the real estate industry, including in executive and leadership positions. He also brings significant public company board experience.

Mr. Frank currently serves on the audit committee of four other public companies, all of which are business development companies under the Investment Company Act of 1940, as amended and are related entities within the same fund family. The Board has determined that such simultaneous service does not impair the ability of Mr. Frank to effectively serve on the Company’s Audit Committee. In making this determination, the Board considered the mix of companies involved and the fact that they are all business development companies within the same fund family, as well as Mr. Frank’s 100% attendance at 2021 meetings of the Audit Committee and the Board, his valued contribution as Audit Committee Chair, and his extensive background and experience in accounting, including as a Certified Public Accountant and former senior partner of Ernst & Young LLP.

|

COMMITTEES |

OTHER PUBLIC COMPANY BOARDS |

|

●Compensation (Chair)

●Nominating and Governance

●Executive Land |

None |

|

BACKGROUND |

|

|

●Served on the Landsea Homes Board from 2017 until the Business Combination.

●Has over 30 years of investment banking experience, much of it in the building products, home building and real estate sectors.

●Served as a senior advisor at Annascaul Advisors LLC, a registered broker-dealer, in New York from 2006 to 2010, when he retired.

●Served as managing director of the Homebuilding and Building Products Group at the global investment bank Houlihan Lokey Howard & Zukin from 2002 to 2006. |

●Served as a managing director and partner at investment bank Dillon Read & Co. and its successor firm, UBS AG, from 1982 to 2001, where he was a senior member of the Homebuilding and Building Products Group and headed the Private Financing Group. His clients included Meritage Homes, Ryland Homes, KB Homes and Highland Homes. At UBS, he started the Private Equity Group.

●Received a B.S. from the University of Oregon and an MBA from Leonard N. Stern School of Business at New York University. |

Mr. Hartfield was selected to serve on our Board due to his extensive experience and industry knowledge of homebuilders, and his 30 years of investment banking experience.

| 2022 Proxy Statement | 19 |

Proposal 1 Election of Directors

|

COMMITTEES |

OTHER PUBLIC COMPANY BOARDS |

|

●Audit

●Compensation

●Nominating and Governance

|

None |

| BACKGROUND | |

|

●Served on the Landsea Homes Board from 2014 until the Business Combination.

●Has over 25 years of experience in real estate transactions, entitlements and related litigation in California and out of state.

●Mr. Miller’s practice involves a range of real estate and development activities, with a skill set that addresses a wide variety of issues that confront real estate developers, owners and builders.

|

●Has been a partner at the law firm Lubin Olson & Niewiadomski LLP in San Francisco, California since 2014.

●Served as general counsel of Braddock & Logan Homes for 15 years.

●Received a bachelor’s degree from Princeton University and a Juris Doctor degree from Harvard Law School.

|

Mr. Miller was selected to serve on our Board due to his considerable leadership roles and homebuilding industry experience.

|

COMMITTEES |

OTHER PUBLIC COMPANY BOARDS |

|

●Audit

|

●LF Capital Acquisition Corp II

|

| BACKGROUND | |

|

●Served on the LFAC Board from 2017 until the Business Combination.

●Has served as Executive Chairman of the board of LF Capital

Acquisitions II, a special purpose acquisition company, since

March 2021.

●Serves as Chief Strategy Officer for Candriam Investors Group, an asset management company with over $140 billion under management, a role he has had since October 2016.

●Member of Candriam’s Group Strategy Committee and Executive Committee.

●Partner of Capital E, a private equity and real estate firm, from 2003 to 2016 and held several board and advisory positions at portfolio companies with ties to Capital E.

●In 2003, founded Velocity Advisors, a private equity advisory firm which sourced and structured transactions on behalf of institutional investors, and served as Managing Partner from 2003 to 2016.

|

●Vice President and Partner at Bain & Company from 1990 to 2002, where he spent 12 years as a management consultant across Europe, the U.S. and Latin America and has advised boards, CEOs and senior management of Fortune 1000 companies as well as several buyout funds on a broad range of strategic, operational, financial and organizational issues.

●Led Bain’s Private Equity Group activities in the Southern US region and was involved in its Investment Committee.

●Currently serves as a director of Lakeside Advisors Inc., a private equity firm registered with the SEC, and Candriam Luxembourg, an asset management company and affiliate of New York Life.

●Previously served as a director of Huron Inc. and CBI, Inc.

●Graduate of Ecole Supérieure des Sciences Economiques et Commerciales (ESSEC) in Paris.

|

Mr. Farhat was selected to serve on our Board due to his experience related to private equity, capital markets, transactional matters and post-acquisition oversight of operational performance at portfolio companies.

| 20 | Landsea Homes |

Proposal 1 Election of Directors

|

COMMITTEES |

OTHER PUBLIC COMPANY BOARDS |

| None |

●Aterian, Inc.

|

| BACKGROUND | |

|

●Has served as Chief Financial Officer for The Row, an international

privately held luxury apparel retailer, since August 2021.

●Previously, worked for Bed Bath & Beyond Inc., an American chain of

domestic merchandise retail stores, for more than 23 where she held

several roles, including Chief Administrative Officer from May 2018

to December 2019; Chief Financial Officer and Treasurer from

February 2014 to May 2018, and leading many areas including finance,

merchandising operations, real estate, and information technology.

●Began professional career at Arthur Andersen LLP, and held

progressive roles including Audit Manager during her tenure, auditing

public and private companies in the consumer products, gaming and

financial industries.

|

●Currently serves as a director on the board of directors of Aterian,

Inc., a technology-enabled consumer products selling platform and is

a member of the compensation committee and audit committee, as

a director on the board and audit committee chair of Farmer Focus,

a private organic and Humane Certified chicken company, and as a

director on the board of ARCTRUST III, a private growth and income

real estate investment trust.

●Received a B.S. in Business Administration, magna cum laude,

from Bucknell University, is a member of the National Association

of Corporate Directors, holds a Private Company Governance

Certification from the Private Directors Association, and is a Certified

Public Accountant.

|

Ms. Lattmann was recommended to us by a member of our Board, and she was selected to serve on our Board due to her leadership experience and background, including as a senior executive of a large public company, her expertise in financial and accounting matters, and her experience on private and public company boards.

|

COMMITTEES |

OTHER PUBLIC COMPANY BOARDS |

| None | None |

| BACKGROUND | |

|

●Has served as Chief Financial and Investment Officer at JPI, a developer, builder and investment manager, since 2021.

●Is also Founder and Partner of Cephas Partners, a private equity firm formed in 2012 that specializes in alternative investments with a primary focus on real estate opportunities.

●Prior to joining Cephas Partners in 2012, served as Vice President at Bank of America Merrill Lynch in the Real Estate Principal Investments group in New York, from May 2006 to December 2011.

●Since 2015 has invested in and advised multiple companies bringing new technologies to the real estate and construction industries.

|

●Previously served on the Global CREW Network Board, serving over 11,000 women in commercial real estate.

●Currently serves as a director on the boards of directors of private companies, including: Pallet, a Social Purpose Corporation focused on portable shelter systems, Green Canopy, an impact real estate development, fund management, and homebuilding company, and Urban Housing Ventures.

●Received a Bachelor’s degree in history and science from Harvard University.

|

Ms. Fadule was recommended to us by a member of our Board, and she was selected to serve on our Board due her experience and background in the real estate and homebuilding industries, and her experience related to private equity, capital markets, financial and transactional matters.

| 2022 Proxy Statement | 21 |

SUSTAINABILITY AND

HUMAN CAPITAL

Sustainability in Our Business

We are a rapidly growing homebuilder focused on providing High Performance Homes (“HPH”) that deliver energy efficient living in highly attractive geographies.

Building on the global homebuilding experience and environmentally focused strategy of Landsea Green, who indirectly owns 100% of our largest stockholder Landsea Holdings, we are driven by a pioneering commitment to sustainability. Drawing on new-home innovation and technology, including a partnership with a leading technology company, we are focused on sustainable, energy-efficient and environmentally friendly building practices that result in a lighter environmental impact, lower resource consumption and a reduced carbon footprint. The three pillars of our HPH platform are home automation, energy efficiency and sustainability. These pillars are reflected in such features as WiFi mesh networking, smart light switches, smart door locks, smart thermostats, WiFi garage door openers; LED lighting and upgraded insulation. Our efficient home designs help reduce lumber, concrete and building material waste on our jobsites.

We are committed to sustainability. We place heavy emphasis on environmental protection and are committed to delivering comfortable and eco-friendly residential properties to the market. Landsea Green has received numerous awards and recognition for various properties and enjoys broad recognition among its customers as one of the few brand names representative of eco-friendly building design and construction.

We are committed to sustainable building practices and conduct a multitude of energy-efficient, sustainable and environmentally-friendly practices that result in a lighter environmental impact, lower resource consumption and a reduced carbon footprint.

In 2019, Landsea Homes officially launched its HPH program in select communities across California and Arizona. The program focuses on home automation, sustainability and energy savings, three factors that we believe are highly desired by our customers.

As part of the HPH program, we have established a partnership with a leading technology company. HPH utilizes such company’s proprietary software, which offers home automation options through applications on homebuyers’ mobile phones. Smart home automation options include a media manager device, MeshNet wireless internet throughout the home, entry door locks, thermostat control, garage door opener control, light dimmer switches, doorbell camera pre-wire and high-touch customer service with an individualized training session.

In addition, each HPH includes upgraded roof insulation, upgraded wall insulation, upgraded floor insulation, more efficient mechanical systems, ENERGY STAR® rated appliances and LED lighting. The cost-in-use features lower homebuyers’ monthly bills and are intended to encourage environmental awareness and stewardship.

Human Capital Management

Retention and Turnover. We focus significant attention on attracting and retaining talented and experienced individuals to manage and support our operations, and our management team routinely reviews employee turnover rates at various levels of the organization. As of December 31, 2021, with a 12-month lookback period, Landsea Homes had a voluntary turnover rate of approximately 13.4%. In total, during this period, Landsea Homes had an involuntary turnover rate of approximately 18.2%, which was largely attributable to corporate restructuring to reduce overhead in response to the COVID-19 pandemic, representing approximately 12.6% of its workforce. During this period, approximately 5.1% of involuntary turnover was the result of operational restructuring of overlapping functions as a result of Landsea Homes’ recent acquisition of Garrett Walker.

Internal Promotion and Compensation. Every year, each manager helps set his or her employees’ professional goals for internal promotion, and monitors employees’ progress throughout the year. Employee compensation is determined based on industry benchmarks and cost of living factors. Bonus incentives are primarily paid out annually based on division performance goals. We recommend and promote continuing education for all employees, and offers tuition reimbursement for job-related curriculum.

Worker Safety and Compliance with Laws. We actively train our employees and management on workplace safety and related laws and regulations. With respect to workplace safety, we utilize a third-party vendor to support compliance with California/Occupational Safety and Health Administration (“OSHA”) and federal OSHA safety requirements. Internally, we have a formal safety committee to review employee safety protocols. During the COVID-19 pandemic, we adopted office and field safety guidelines, supplied personal protective equipment to staff and implemented work from home protocols as recommended by the Center for Disease Control and Prevention. With respect to compliance with employment-related laws and regulations, we provide management training on leadership development, the progressive discipline process, and updates on labor laws, protected leaves and wage and hour rules. In addition, our employees are required to complete a two-hour harassment prevention training.

| 22 | Landsea Homes |

| PROPOSAL 2 | ||

|

Ratification of Appointment of Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP (“PwC”) has served as the Company’s independent registered public accounting firm since March 18, 2021, and had served as principal accountants to Landsea Homes since 2019. Representatives of PwC are expected to be present at the Annual Meeting and will have an opportunity to make a statement if they wish and be available to respond to appropriate questions from stockholders. We are asking stockholders to ratify the Audit Committee’s selection of PwC as our independent registered public accounting firm for the fiscal year ending December 31, 2022. While such ratification is not required, the Board is submitting the selection of PwC to our stockholders for ratification as a matter of good corporate practice. If stockholders do not ratify the selection of PwC as our independent registered public accounting firm for the fiscal year ending December 31, 2022, our Audit Committee may reconsider the selection of PwC as our independent registered public accounting firm. Even if the selection is ratified, the Audit Committee may, in its discretion, select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and our stockholders. |

||

|

Our Board of Directors recommends a vote “FOR” the ratification of the selection by the Audit Committee of PwC as our independent registered public accounting firm.

|

Independent Public Accountant

The following is a summary of fees paid or to be paid to PwC for services rendered over the prior two fiscal years.

| FOR THE YEAR ENDED DECEMBER 31, 2021* |

FOR THE YEAR ENDED DECEMBER 31, 2020* | |||||

| Audit Fees(1) | $ | 1,576,700 | $ | 1,028,000 | ||

| Audit-Related Fees(2) | $ | 453,000 | $ | 927,763 | ||

| Tax Fees | $ | – | $ | – | ||

| All Other Fees(3) | $ | 900 | $ | 1,800 | ||

| Total | $ | 2,030,600 | $ | 1,957,563 | ||