Exhibit 99.2

INVESTOR PRESENTATION August 2020

2 DISCLAIMER This presentation is contemplates a business combination (the “Transaction”) pursuant to an Agreement and Plan of Merger (the “Merger Agreement”) by and among LF Capital Acquisition Corp., a Delaware corporation (“LF Capital”), LFCA Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of LF Capital, Landsea Holdings Corporation, a Delaware corporation, and Landsea Homes Incorporated, a Delaware corporation and wholly-owned subsidiary of Landsea Holdings Corporation (“Landsea”, together with LF Capital, “we” or “us”), dated as of August 31, 2020. This presentation discusses a the Transaction and does not purport to be all-inclusive or to give you any legal, tax or financial advice. This presentation does not constituteor involve,andshouldnotbetakenasconstitutingorinvolving,thegivingofanyinvestmentadvice,orthemakingofanyrepresentation, warrantyorcovenantwhatsoever byLFCapital,Landseaoranyotherperson. This presentation does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Transaction or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to buy any security of LF Capital, Landsea or any of their respective affiliates. You should not construe the contents of this presentation as legal, tax, accounting or investment advice or as a recommendation with respect to the voting, purchase or sale of any security or as to any other matter. The information presented herein is not a complete description and is not an offer to buy or sell any securities of any Company. PAST PERFORMANCE IS NO GUARANTEE OF FUTUREPERFORMANCE. Forward-Looking Statements Certainstatements inthispresentation constituteforward-looking statements withinthemeaningofSection27AoftheSecuritiesActof1933,asamended, andSection21EoftheSecuritiesExchange Actof1934,asamended,conveying the expectations ofmanagementofLFCapitaland/orLandsea astothefuturebasedonplans,estimatesandprojections atthetimeLFCapitaland/orLandseamakesthestatements.Forward-lookingstatementsinvolveinherentsignificantrisks and uncertaintiesandwecautionyouthatanumberofimportantfactorscouldcauseactualresultstodiffermateriallyfromthosecontainedinanysuchforward-looking statement.Theforward-looking statementscontainedinthispresentation include, but are not limited to, statements related to the Transaction between us and the proposed terms thereof, Landsea’s business, industry, strategy and ability to grow, the anticipated future business and financial performance of the combined company following the Transaction, the anticipated timing of the transactions described herein, the ability to complete the transactions on the terms and within the timeframe contemplated herein, the ability to finance the Transaction and any investor redemptions, the abilityofthepartiestothetransactiontosatisfytheclosingconditionstothetransaction,andthepotentialimpactthetransactionscontemplatedherebywillhaveonLFCapitalandtheCompanyGroupandtheirrespectivebusinesses. You can identify these statements by forward-looking words such as “may”, “expect”, “anticipate”, “contemplate”, “believe”, “estimate”, “plans,” “intends”, “targets,” “will,” “expects,” “suggests,” “anticipates,” “outlook,” “continues,” “projects,” “forecasts”, “continue”orsimilarwords.Youshouldreadstatementsthatcontainthesewordscarefullybecausethey:discussfutureexpectations; containprojectionsoffutureresultsofoperations orfinancialcondition;orstateother“forward-looking” information. The forward-looking statements contained in this presentation are based on our current expectations about future events and trends that it believ es may affect LF Capital’s, Landsea’s or the combined company’s financial condition, results of operations, strategy, short-term and long-term business operations and objectives and financial needs. You should not place undue reliance upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements contained herein are reasonable, no guarantee can be made as to future results, performance or achievements. There may be events in the future that we are not able to predict accurately or over which we have no control. The cautionary language discussed in this presentation provides examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described by us in such forward-looking statements, including, among other things,claimsbythirdpartiesagainsttheTrustAccount,unanticipateddelaysinthedistributionofthefundsfromtheTrustAccount,ourabilitytofinanceandconsummatetheTransaction,thebenefitsoftheTransaction,thebusinessprospects of Landsea, expansion plans and opportunities, the impact of the COVID-19 pandemic and its effects on us, our respective businesses, vendors, customers and communities, U.S. and world financial markets, potential regulatory actions, changes in stakeholder behaviors, andimpactsonandmodificationstoouroperations, businesses, orfinancialconditionrelatingthereto.Youarecautionednottoplaceunduerelianceontheseforward-looking statements,whichspeakonlyasofthedatehereof. All forward-looking statements included herein are expressly qualified in their entirety by the cautionary statements contained or referred to in this disclaimer. Except to the extent required by applicable laws and regulations, we undertake no obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise. Additional Information and Where to Find It In connection with the Transaction, LF Capital Acquisition Corp. intends to file with the SEC a proxy statement (the “Proxy Statement”). This presentation is not a substitute for the Proxy Statement or any other document that LF Capital Acquisition Corp. may file with the SEC in connection with the Transaction (collectively, including any amendments or supplements to any of the foregoing, the “Additional Documents”). This presentation is for informational purposes only and does not constitute an offer tosellora solicitationtobuyanysecuritiesanddoesnotconstituteanyformofcommitmentorrecommendationonthepartofus,ourrespectiverepresentatives andadvisors,oranyoftheirrespectivesubsidiaries,affiliates orassociated companies, or any other person or entity. STOCKHOLDERS OF LF CAPITAL ACQUISITION CORP. ARE URGED TO READ THE PROXY STATEMENT AND ANY ADDITIONAL DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT US, THE TRANSACTION AND RELATEDMATTERS. Stockholders of LF Capital Acquisition Corp. will be able to obtain free copies of the Proxy Statement and any Additional Documents containing important information about the Transaction once these documents are filed with the SEC by visiting a website maintained by the SEC at http://www.sec.gov or by contacting LF Capital Acquisition Corp. at 600 Madison Avenue, Suite 1802, New York, NY 10022, phone number (212)319-6550.

3 DISCLAIMER Participants in the Solicitation LF Capital Acquisition Corp., Landsea, their respective affiliates, and each of their respective directors, officers and employees may be deemed to be participants in the solicitation of proxies from the stockholders of LF Capital Acquisition Corp. in connection with theTransaction. Information regarding the identity of LF Capital Acquisition Corp.’s directors and executive officers and their ownership of its common stock is set forth in LF Capital Acquisition Corp.’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed with the SEC on February 24, 2020, and in its prior proxy statements, including the proxy statement for its 2020 annual meeting of stockholders, filed with the SEC on October 30, 2019. Additional information regarding the interests of such participationsintheTransactionwillbeavailableintheProxyStatementandtheAdditionalDocuments.YoumayobtainfreecopiesofthesedocumentsthroughtheSEC’swebsiteorbycontactingLFCapitalAcquisitionCorp.,asdescribedabove. Non-GAAP FinancialMetrics This presentation contains certain financial information determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). Any non-GAAP financial measures and other non-GAAP financial informationusedinthispresentation areinadditionto,andshouldnotbeconsideredsuperiorto,orasubstitutefor,financialmeasuresprepared inaccordancewithGAAP.Non-GAAP financialmeasuresandothernon-GAAP financialinformation is subject to significant inherentlimitations. We believe that the disclosure of these “non-GAAP” financial measures presents additional information which, when read in conjunction with our consolidated financial statements prepared in accordance with GAAP, assists in analyzing our operating performance and the Transaction. Additionally, we believe this financial information is utilized by regulators and market analysts to evaluate a company’s financial condition, and therefore, such information is useful to investors. The non-GAAP financial measures should not be viewed as substitutes for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. A reconciliation of the non- GAAP financial measures used in this presentation to the most directly comparable GAAP measures is provided in Appendix B to thispresentation. Market and IndustryData Market data and industry data used throughout this presentation is based on information derived from third party sources, each of our management’s knowledge of their respective industries and businesses, and good faith estimates by our management teams. While we believe that the third party sources from which market and industry data has been derived are reputable, we have not independently verified such market and industry data, and you are cautioned not to give undue weight to such market and industrydata. Use ofProjections The projections included herein are forward-looking statements and are subject to risks and uncertainties that could cause actual results to differ materially from those statements and should be read with caution. They are subjective in many respects and thussusceptibletointerpretations andperiodicrevisionsbasedonactualexperience andrecentdevelopments. Whilepresentedwithnumericalspecificity,theprojectionswerenotpreparedintheordinarycourseandarebaseduponavariety of estimates and hypothetical assumptions made by management of the LF Capital and Landsea with respect to, among other things, general economic, market, interest rate and financial conditions, the availability and cost of capital for future developments, the timing of borrowers repaying developments, competition within Landsea’s markets, real estate and market conditions. The projections were not prep ared with a view toward compliance with published guidelines of the SEC, the guidelines established by the American Institute of Certified Public Accountants for prospective financial information or GAAP. None of the assumptions underlying the projections may be realized, and they are inherently subject to significant business, economic and competitive uncertainties and contingencies, all of which are difficult to predict and many of which are beyond our control. Accordingly, there can be no assurance that the assumptions made in preparing the projections will prove accurate, and actual results may materially differ. For these reasons, as well as the bases and assumptions on which the projections were compiled, the inclusion of the informat ionset forth below should not be regarded as an indication that the projections will be an accurate prediction of future events, and they should not be relied on as such. We have not, nor any of our respective affiliates, advisors or other representatives has made, or makes, any representation to any stockholder regarding the information contained in the projections and, except as required by applicable securities laws, neither of us intends to update or otherwise revise the projections to reflect circumstances existing after the date when made or to reflect the occurrences of future events even in the event that any or all of the assumptions are shown to be in error. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY REGULATORY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. THIS PRESENTATION DOES NOT CONSTITUTE AN OFFER OR SOLICITATION OF ANY SECURITIES. THE COMPANY WILL MAKE ANY OFFER TO SELL SECURITIES ONLY PURSUANT TO A DEFINITIVE SUBSCRIPTION AGREEMENT. THE COMPANY RESERVES THE RIGHT TO WITHDRAW OR AMEND FOR ANY REASON ANY OFFERING AND TO REJECT ANY SUBSCRIPTION AGREEMENT IN WHOLE OR IN PART FOR ANYREASON.

4 TODAY’SSPEAKERS ScottReed CEO & President, LFCapital Founder of BankCap Partners, a bank-focused private equity firm Director at Silvergate Capital (public), InBankshares (public), Vista Bancshares (private), Uncommon Giving (private) Formerly with Swiss Bank/O’Connor (derivatives trading), Bain & Co (strategy consulting), Bear Stearns (investmentbanking) JohnHo ChiefExecutiveOfficer,LandseaHomes EstablishedLandseaHoldingsCorporationin 2013,overseeingthesignificantgrowthofthe businessfromitsfirstlandacquisitiontomost recenthomebuilderacquisitions Former Director/VP at Jones Lang LaSalle Previously Director at ColliersInternational MichaelForsum PresidentandChiefOperatingOfficer, LandseaHomes 30+ years of experience in the industry, key in expanding business into new markets and setting up strategy of growth by identifying potential opportunities in Texas andFlorida Former Co-Founder of Starwood Land Ventures and Arcadia DMBCapital Previously Western Region President at Taylor Woodrow/Morrison FPO

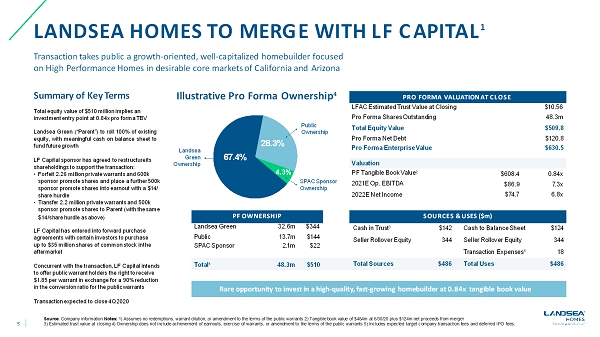

5 LANDSEAHOMESTOMERGEWITHLFCAPITAL 1 Source: Company information Notes: 1) Assumes no redemptions, warrant dilution, or amendment to the terms of the public warrants 2) Tangible book value of $484m at 6/30/20 plus $124mnet proceeds from merger 3)Estimatedtrustvalueatclosing4)Ownershipdoesnotincludeachievementofearnouts,exerciseofwarrants,oramendmenttothetermsofthepublicwarrants5)IncludesexpectedtargetcompanytransactionfeesanddeferredIPOfees. Transaction takes public a growth-oriented, well-capitalized homebuilder focused on High Performance Homes in desirable core markets of California andArizona Summary of KeyTerms Total equity value of $510 million implies an investment entry point at 0.84x pro formaTBV LandseaGreen(“Parent”)toroll100%ofexisting equity,withmeaningfulcashonbalancesheetto fundfuturegrowth LF Capital sponsor has agreed to restructureits shareholdings to support thetransaction: •Forfeit 2.26 million private warrants and 600k sponsor promote shares and place a further500k sponsor promote shares into earnout with a $14/ sharehurdle •Transfer 2.2 million private warrants and 500k sponsor promote shares to Parent (with thesame $14/share hurdle asabove) LF Capital has entered into forward purchase agreements with certain investors to purchase up to $35 million shares of common stock inthe aftermarket Concurrent with the transaction, LF Capital intends to offer public warrant holders the right toreceive $1.85 per warrant in exchange for a 90%reduction in the conversion ratio for the publicwarrants Transaction expected to close4Q2020 PRO FORMA VALUATIONAT CLOSE LFAC Estimated Trust Value at Closing Pro Forma SharesOutstanding $10.56 48.3m Total EquityValue $509.8 Pro Forma NetDebt $120.8 Pro Forma EnterpriseValue $630.5 Valuation PF Tangible BookValue 2 2021E Op.EBITDA 2022E NetIncome $608.4 $86.9 $74.7 0.84x 7.3x 6.8x SPACSponsor 2.1m $22 PFOWNERSHIP SOURCES & USES($m) LandseaGreen 32.6m $344 Cash inTrust 3 $142 Cash to BalanceSheet $124 Public 13.7m $144 Seller RolloverEquity 344 Seller RolloverEquity 344 TransactionExpenses 5 18 Total 1 48.3m $510 TotalSources $486 TotalUses $486 Illustrative Pro FormaOwnership 4 Rare opportunity to invest in a high-quality, fast-growing homebuilder at 0.84x tangible book value 67.4% 28.3% 4.3% Landsea Green Ownership Public Ownership SPACSponsor Ownership

WHAT WEDO Driven by a pioneering commitment to sustainability, Landsea Homes designs and builds homes and communities throughout the nation that reflect modern living –inspired spaces and features, built in vibrant, prime locations where they connect seamlessly with their surroundings and enhance the local lifestyle for living, working and playing. And the defining principle, “Live in Your Element ® ,” creates the foundation for our customers to live where they want to live, how they want to live –in a home created especially forthem. 6

At Landsea Homes, we exist to make a positive impact on the lives of our employees, customers and all stakeholders by revolutionizing the industry. It starts with the acknowledgment that incrediblecustomer experiences begin with incredible employee experiences. That commitment extends to our financial and building partners, whom we strive to provide with consistency and predictability. And it’s all manifested in homes and communities that are more than just structures and developments. Taken together, they are the single most important place inlife. WHY WEEXIST 7

8 LANDSEASNAPSHOT Overview Landsea was founded in 2013 and commenced U.S. homebuilding operations in2014 Headquartered in Newport Beach,CA Growth-oriented homebuilder focused on entry-level and move-up price points in desirable U.S. markets with a concentration in Arizona andCalifornia Completed acquisitions of Pinnacle West Homes in 2019 and Garrett Walker Homes in2020 The High Performance Homes program, developed by Landsea Homes, is an industry-leading program that provides homebuyers with focus on home automation, sustainability and energy savings Source: Landsea HomesManagement Q2 –2020 OperatingHighlights OperatingMetrics 1,302 LTMOrders 35 ActiveCommunities 932 LTMDeliveries $ 660k ASP ofDeliveries 856 BacklogUnits $ 376m BacklogValue $ 440k BacklogASP 5,394 Lots Owned &Controlled FinancialMetrics $ 641m 20% $ 56m $ 907m LTMRevenues LTM Adj. Homebuilding GM% LTM AdjustedEBITDA TotalAssets Unique product differentiation strategy through new home innovation and cutting-edge technology, including a strategic partnership with a “Big Five” technologycompany.

9 COMPANY HIGHLIGHTS Strong financial performance and solid balance sheet provide firepower forgrowth Differentiated platform rooted in innovation, energy efficiency and sustainability that attracts today’shomebuyers Experienced leadership with entrepreneurial culture driving fundamentalexecution Focused on entry-level and move-up homes in high-growthmarkets Strategically desirable portfolio of land positions and communities, creating significantvalue Expertise in executing acquisitions and developing high-qualitycommunities

10 DIFFERENTIATED PLATFORM ADDRESSINGTHENEEDSOFTODAY’SHOMEBUYER The High Performance Homes program is an industry-leading program thatprovides homebuyers with a three-tiered approach that includes home automation, sustainability and energy savings. Designed to provide a superior living environment, the program is aimed at enhancing a home’s comfort and durability, improving indoor air quality, delivering cutting- edge home automation solutionsthrough a strategic partnership with a “Big Five” technology company, reducing energy costs and lessening the consumption of the earth’s preciousresources. 5,950 Total PageEngagement HPH DigitalPerformance 2/10/20 –6/30/20 66,825 Page Views HomeAutomation Live the ConnectedLife Sustainability To Live Lightly on theLand EnergySavings Modern Living MadeSmarter

11 LEADINGTHEVIRTUALSALESPROCESS Landsea Homes was well positioned to quickly adapt to the current conditions caused by COVID-19 and is an industry leader in the use of innovative technology to maximize the experience for futureresidents. Giving home shoppers a “you are here” experience with a variety of online tools, including videos, 360 virtual tours, photo galleries, interactive floor plans, site maps and local areamaps. Dedicated Inside Sales Counselors support all division/ community web leads, phone calls and on-site appointments seven days aweek. 25,525 Direct PhoneCalls to InsideSales 1,350 Total On-Site Appointments 972 Net Orders 417,800 Unique WebUsers 1/1/20 –6/30/20

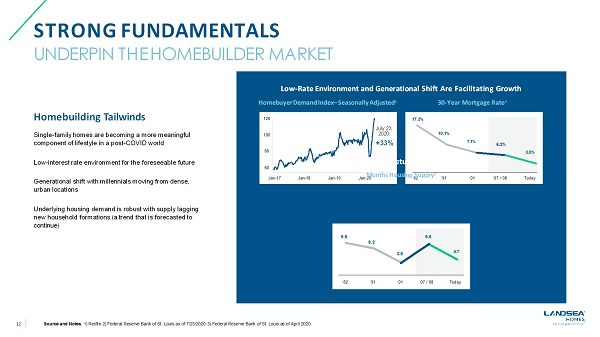

12 HomebuildingTailwinds Single-family homes are becoming a more meaningful component of lifestyle in a post-COVIDworld Low-interest rate environment for the foreseeablefuture Generational shift with millennials moving from dense, urban locations Underlying housing demand is robust with supply lagging new household formations (a trend that is forecasted to continue) SourceandNotes:1)Redfin2)FederalReserve BankofSt.Louisasof7/23/20203)FederalReserve BankofSt.LouisasofApril 2020. STRONGFUNDAMENTALS UNDERPIN THEHOMEBUILDER MARKET 120 100 80 60 Jan-17 Jan-18 Jan-19 Jan-20 ‘82 ‘91 ‘01 ‘07 /‘08 Today 17.3% 7.1% 6.2% 3.0% 10.1% Low-Rate Environment and Generational Shift Are FacilitatingGrowth HomebuyerDemandIndex–SeasonallyAdjusted 1 30-Year MortgageRate 2 Housing Supply Returning to ’01Levels Months HousingSupply 3 ‘82 ‘91 ‘01 ‘07 /‘08 Today 9.8 8.2 3.8 9.6 4.7 July23, 2020: +33%

13 FAVORABLEDYNAMICS ENTRY-LEVEL AND FIRSTMOVE-UP HOMES Source: National Association of Realtors, Pew Research, John Burns Real Estate Consulting survey, Federal Reserve of St.Louis Notes:1)PewResearch2)Asof8/16/20193)JohnBurnsRealEstateConsulting–IndependentsurveydataasofMay20204)FederalReserveHouseholdEstimatesasofJuly2020. Millennials The largest generation in the U.S. labor force (35%) 1 Have become the largest cohort of homebuyers at 37% of allhomebuyers 2 From 2014 to 2018, U.S. household formations averaged ~1.3m/year as compared to ~740k from 2007 to2013 4 Urgency &Convenience More homebuyers are entering the market due to COVID-related reasons, including better mortgage rates/prices, disliking home layout or needing a larger home Most recent buyers who purchased new homes were looking to avoidrenovations and looked forcustomization 1 9% of Buyers Nationally AreExpediting Purchases from Their Shelter-in-Place Experiences 3 17% Northern Cal 11% Florida 11% Southeast 11% Texas 9% National 8% Midwest 7% Northwest 6% Southern Cal 6% Northeast 5% Southwest 51% of Builders Selling to First-Time Buyers NoteIncreasedBuyerUrgency 3 First-Time Move-Up Significantly increased urgency Nochange Significantly decreased urgency Somewhat increased urgency Somewhat decreased urgency 12% 5% 2 4 % 11% 39% 35% % 13% 14% 23% 19% 23% 20% 35% 43% 20% 38% 46% 10% 26% 10% 27% 23% Luxury ActiveAdult EmptyNester

14 FOCUSED ONENTRY-LEVELHOMES IN HIGH-GROWTHGEOGRAPHIES Lots Owned/Controlled 1 by ProductClass Supply of Lots 1 byState Source: Landsea Homes Management Note: 1) As of June 30, 2020 Other NewYork Move-Up 10% 523 1% 84 Entry-Level 89% 4,787 Arizona 72% 3,875 California 27% 1,469 1% 50

15 FOCUSED ONENTRY-LEVELHOMES IN HIGH-GROWTHGEOGRAPHIES 2020E Revenue byGeography California 53% $ 371m Arizona 47% $ 326m 2020E Revenue by ProductClass Source: Landsea HomesManagement Entry-Level 66% $ 459m Move-Up 33% $ 233m Other 1% $ 5m

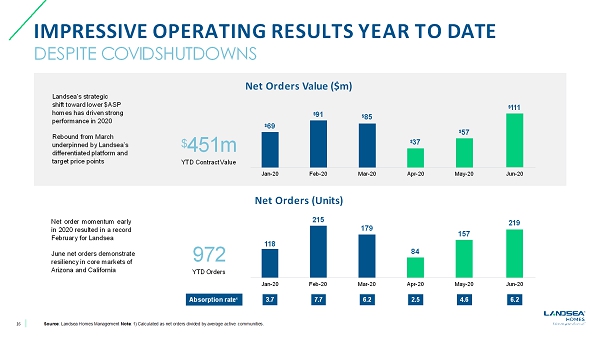

16 IMPRESSIVEOPERATINGRESULTSYEARTODATE DESPITE COVIDSHUTDOWNS Landsea’s strategic shift toward lower$ASP homes has drivenstrong performance in2020 Rebound from March underpinned by Landsea’s differentiated platform and target price points Net Orders Value ($m) Netordermomentumearly in2020resultedinarecord FebruaryforLandsea June net orders demonstrate resiliency in core markets of Arizona andCalifornia $ 451m YTD ContractValue 972 YTDOrders Jun-20 $ 111 May-20 $ 57 Apr-20 $ 37 Mar-20 $ 85 Feb-20 $ 91 Jan-20 $ 69 Absorption rate 1 6.24.62.56.27.73.7 Jun-20 219 May-20 157 Apr-20 84 Mar-20 179 Feb-20 Net Orders(Units) 215 Jan-20 118 Source: Landsea Homes Management Note: 1) Calculated as net orders divided by average active communities.

17 OURCORE MARKETS:CALIFORNIA Most populous state in the U.S., benefiting from stable employment growth and supply- constrained housingmarkets Third-fastest growing state in the country in terms of numeric populationgrowth 1 From 2012 to 2017, had median household income in the top 15 and rose 16.5% from 2014 to2018 2 San Francisco metro area housing market median sale price growth of 11% since2015 3 Los Angeles metro area housing market median sale price growth of 15% since2015 3 Growing opportunity to service outside metro areas as demand increases for lower priced homes Neuhouse,Ontario Crestley,Chatsworth IronRidge, LakeForest ShadeTree,Ontario The Westerly, SimiValley Lido Villas, NewportBeach Stoneyridge, WalnutCreek The Vale,Sunnyvale Skylark,Newark Abigail Place,Danville Catalina, SantaClara Relevae,Orinda NORTHERN CALIFORNIA NORTHERN CALIFORNIA SOUTHERN CALIFORNIA SOUTHERN CALIFORNIA Source:U.S.CensusBureau,BureauofEconomicAnalysisNotes:1)2017–20182)Incurrentdollars3)LTMavg.asofMay20vs.LTMavg.asofMay2015.

18 CASESTUDY:THEVALE,SUNNYVALE,CA ProjectOverview Acquired 25 acres of entitled land (former AMD semiconductor plant) Master-planned community of 450 townhomes between three distinct communities Landsea was the master developer for all threecommunities Built out two communities for total of 314 attached row-styletownhomes Sold one community consisting of 136 attached townhomes toTMHC Extremely successful sales, averaging 10 new homes sales per month 314 Homes Delivered $ 423m Home SalesRevenue 136 LotsDelivered $ 63m Lot SalesRevenue 23% Home Sales GM% 30% Adj. Home Sales GM%1 $ 67m PretaxProfit 14% Pretax Margin% Source: Landsea Homes Management Note: 1) Adjusted home sales GM % excludesinterest.

19 OURCORE MARKETS:ARIZONA High-growth market with strong underlyingfundamentals Fourth-fastestgrowingstatein thecountryintermsofpercent populationgrowth 1 Top 10 state for personal income growth 2 From 2014 to 2018, median household income in Arizona rose 26.5%, the eighth-fastest growth rate in theU.S. 3 25% decline in housing inventory growth since 2015, second-lowest in theU.S. 4 Source:U.S.CensusBureau,BureauofEconomicAnalysisNotes:1)2017–20182)%changeQ4 19–Q1203)Incurrentdollars4)LTMavg.asofMay20vs.LTMavg.asofMay2015. Sonora Crossing,Chandler Germann Country Garden Estates,Chandler Harvest, QueenCreek Sundance,Buckeye Centerra,Goodyear Olive Grove,Glendale Verrrado,Buckeye The Villages at North Copper Canyon,Surprise Alamar,Avondale PHOENIX/ SCOTTSDALE AREA

20 PROVEN ACQUISITIONPLAYBOOK WITHEXPANSION INTO ARIZONA Source: Landsea HomesManagement Disciplined Approach toAcquisitions Attractive target in high-value homebuildingmarkets Management team with deep experience in the regions itenters Targeting the “rightmarkets” Utilize same discipline developed in California, following the three-step approach 1 Land acquisition in newmarkets 2 Develop relationships and sub-contractor list while pursuing accretiveacquisitions 3 Builder acquisition Retain employees, further build out relationships andscale Acquirer ofChoice Strategic focus on roll-up strategy, targeting undercapitalized players who have built up their businesses as far as they can with localcapital Owners looking to sell to the right player who will take care of theemployees Deep relationships and strong institutional knowledge acrossgeographies

21 PROVEN ACQUISITIONPLAYBOOK WITHEXPANSION INTO ARIZONA Source: Landsea Homes Management Notes: 1) Excludes an estimated 5% of sellingcosts. Entered the Arizona market with two acquisitions in the last 12months Created a top 5 homebuilder in Arizona, as of YTD April 2020, with over 1,200 deliveries in2020 Provides significant diversification outside the Californiamarket Gives Landsea land positions within best-selling master-planned communities and lots that are complementary to current portfolio (Acquired in June2019) $ 49m 2018Revenue 180 2018 HomesDelivered $ 137m 2019Revenue 510 2019 HomesDelivered 16 26% 18 24% 1 Owned/Controlled Communities 2018 Adj. Homebuilding GrossMargin Owned/Controlled Communities 2019 Adj. Homebuilding GrossMargin (Acquired in January2020)

22 LANDSEA GROWTHSTRATEGY Source: Landsea HomesManagement Expand community count in our current operating divisions and grow marketshare California Arizona Maintain an appropriate supply of land in key markets for futurebuildout Diversification across product offerings with a focus on entry-level and first move-up homebuyers in desirable newmarkets Created a solid foundation of entry-level homes with select opportunistic infilllocations Explore geographic expansion opportunities in desirable new markets (e.g., Texas and Florida) organically or viaM&A Strengthen unique brand position through productdifferentiation The parent company is a pioneer in the use of green technology homebuilding with the global perspective providing a unique advantage LandseaHighPerformanceHomesaredesignedtothehighest standardsinsustainablebuildingtechnology,homeautomation, smartsecurity,energy-savingefficiencyandhealth-centricliving Gain access to growth capital while keeping conservative leverageprofile Diversify sources of capital by becoming a publicly traded homebuilder in theU.S.

23 SUBSTANTIAL GEOGRAPHIC RUNWAY FOR FUTUREGROWTH Source: Builder Magazine(2019) # 19 Seattle # 14 Nashville # 8 Charlotte # 6 Orlando # 12 Miami # 15 Raleigh # 7 Washington,D.C. # 3 Atlanta # 20 Jacksonville # 18 NYC # 9 SanAntonio # 1 Dallas # 2 Houston # 10 Denver # 13 LasVegas # 16 Riverside # 17 LosAngeles Tampa # 11 # 5 Austin # 4 Phoenix Signifies markets in which Landsea is currently targeting opportunities Signifies Landsea coremarket Rank (of top 20 largest new home markets) Signifies Landsea presence in market SanFrancisco

24 Source: Landsea HomesManagement Note:1)Assumesnoredemptions,noexerciseofwarrantsandnoamendmenttothetermsofthepublicwarrants. AcquisitionFirepower Key FinancialCriteria Homebuilders Geography Texas Florida Geography Goodyear,AZ Surprise, AZ Anaheim, CA Tracy,CA Target Target A TargetB Target LandA LandB LandC LandD Land 18+% Adj. Home Gross Margin 15+% 5-YearIRR 22+% IRR (RawLand) 250k??–??500k ASP of Deliveries 18+% GrossMargin 6x??–??8x EBITDAMultiple 18+% 20+% IRR(FinishedLots) IRR (EntitledLots) 23.9% 16.1% Pro FormaNet Debt-to-Net BookCap ~$419m Acquisition Firepower 1 Criteria Criteria ILLUSTRATIVEUPSIDE FROMACQUISITIONS Target NetDebt-to-Net BookCap 40%

25 44.9% CAPITALSTRUCTURE WITH ROBUSTLIQUIDITY Landsea has a conservative net debt-to-net book capitalization ratio and strong liquidity position with $204m of pro formacash 1 Significant Financial Flexibility to Execute OurStrategy Source:LandseaHomesManagement,companyfilingsasofAugust26,2020Note:1) BasedonJune2020balancesheetandproformafortransactionassumingnoredemptions,exerciseofwarrants,oramendmenttothetermsofthepublicwarrants. Conservative Capitalization Relative toPeers Landsea Homes 1 Meritage Homes 16.1% 20.4% 23.2% 30.2% 33.6% 47.5% MDC TRIPointe Homes M/I Century Taylor Homes CommunitiesMorrison Median:31.9% $ 324m TotalDebt $ 80m Cash $ 124m Net Proceeds from Merger 16.1% Pro Forma Net Debt/ Net BookCap $ 121m Pro Forma NetDebt

26 FINANCIAL PROJECTIONS $ 1.2b – $ 1.3b Revenue 12% –13% Operating EBITDAMargin 30% –40% Net Debt to Net BookCap 10% –12% ROE Revenue(Millions) Adj. Net Income(Millions) Net Debt to Net BookCapitalization Strong Backlog of $376m Anchors ForecastedAssumptions Deliveries(Units) ASP of Deliveries(Thousands) Medium-Term Target Owned/Controlled Land & Future LandAcquisitions Future BusinessAcquisition 290 $379 $631 $697 798 $1,183 326 932 244 597 1,462 1,735 1,725 1,979 2,657 $1,204 $953 $476 $446 $75 28 47 $44 8 36 $25 $36 $26 $445 20% 6% 6% 22% 29% 2018 20182018 20182019 2019 CAGR ‘19 –‘22: 64% CAGR ‘19 –‘22: 23% CAGR ‘19 –‘22: 27% 2019 2020E 2021E 2018 2019 2020E 2021E 2022E 2019 2020E 2021E 2022E 2020E 2021E 2022E2022E 2020E 2021E 2022E $883 85 798 857 47 Source: Landsea HomesManagement

27 ROBUST FINANCIALPROFILE Source: Management; Broker estimates as of August 26, 2020 Landsea MTH MHO CCS MDC TPH TMHC Landsea MTH TPH MDC CCS TMHC MHOLandsea TPH MTH MHO MDC TMHC CCS 18% 22% 22% 21% 21% 20% 20% 10% 10% 25% 14% 21% 21% NM 21% ’19A –’22E: 27% 14% 13% 12% 10% 10% NMNA 14% 11% 10% 6% 11% 13% AND OPERATINGMOMENTUM Revenue Growth Compared toPeers ’19A –’21E Adjusted Net Income Growth Compared toPeers ’19A –’21E Operating EBITDA Margin Compared toPeers 2021E Landsea TMHC MDC MTH CCS MHO TPH Fully Adj. Homebuilding GM Compared toPeers 2021E 21% PeerMedian 12% PeerMedian 21% PeerMedian 11% PeerMedian

28 DESIRABLE VALUATIONENTRYPOINT P/TBV EV/Inventories 2021EEV/EBITDA2021EP/E Source:Management;BrokerestimatesasofAugust26,2020Notes:1)BasedonPFTBVincluding$124mnetproceedsfrommerger2)EBITDAforLandseaHomesrepresentsoperatingEBITDA. Landsea MTH MDC TMHC CCS TPH MHO Landsea MTH MDC CCS TMHC TPH MHO Landsea TMHC TPH MTH MDC CCS MHO Landsea Landsea ’21 ’22 0.84x 1 1.93 11.7x 6.8x 8.2x 9.9x 7.8x 9.0x 7.6x MTH MHO TPH MDC CCS TMHC 8.6x 0.86x 7.3x 10.1x 7.1x 6.9x 7.2x 7.3x NA 1.62x 1.40x 1.18x 1.13x 1.09x 1.04x 1.59x 1.32x 1.21x 1.16x PeerMedian 1.27x PeerMedian 1.21x 1.21x 8.4x PeerMedian 7.2x PeerMedian

29 COMPANYHIGHLIGHTS Strong financial performance and solid balance sheet provide firepower forgrowth Differentiated platform rooted in innovation, energy efficiency and sustainability that attracts today’shomebuyers Experienced leadership with entrepreneurial culture driving fundamentalexecution Focused on entry-level and move-up homes in high-growthmarkets Strategically desirable portfolio of land positions and communities, creating significantvalue Expertise in executing acquisitions and developing high-qualitycommunities

APPENDIX A

31 HIGHLYEXPERIENCED EXECUTIVE MANAGEMENTTEAM Industry Experience: 30years Former Co-Founder of Starwood Land Ventures and Arcadia DMBCapital Previously Western Region President at TaylorWoodrow/Morrison Industry Experience: 14years Former VP of Sales at Richmond AmericanHomes Previously worked for SheaHomes Industry Experience: 17years Former Western Regional Counsel at TollBrothers Previously an attorney at Holland & Knight LLP Industry Experience: 28 years Former VP at TaylorMorrison Industry Experience: 15years Former VP/Corporate Controller at The New HomeCompany Previously at John Laing Homes and E&Y Industry Experience: 25+years Former President of California Division at Starwood LandVentures Industry Experience: 15years Former Director/VP at Jones Lang LaSalle Previously Director at Colliers International Industry Experience: 18years Former VP of Marketing at Oakwood Homes and Henry WalkerHomes Previously worked for Richmond AmericanHomes MichaelForsum President andChief OperatingOfficer JoshSantos Division President NorthernCalifornia FrancoTenerelli Chief LegalOfficer TomBaine Division President SouthernCalifornia MikeCunningham SVPAccounting andFP&A GregBalen DivisionPresident Arizona JohnHo ChiefExecutive Officer MichelleByrge Vice President CorporateMarketing

32 LandseaGroupCo.isatop100realestatecompanyin ChinaandChina’sleadinggreentechnologyresidential propertydeveloper.Holdingsincludethefollowing: 30 three-star green building residentialprojects 64% market share for building energy-efficient homes acrossChina Leader in the use of comfortable energy-efficientproducts Landsea Group Co. has been developing property internationally since2001 Fourth-largest multifamily developer inChina Operates assisted living and memory care facilities in sixcities Majority shareholder of Landsea Green Group Co. Ltd., Landsea’sparent Supplies homes and related services to thefollowing: Over 300,000 customers Over 20 cities inChina Total developed GFA over 18 million squaremiles Has a real estate investment management business with over $1 billion undermanagement Note: 1) Landsea Green Group Co. Ltd. and Landsea Group Co. assumes 0.149 CNY-USD conversion rate. PARENTOVERVIEW Revenue($m)1 Operating Profit($m)1 Real Estate Inventories($b)1 Total Assets($b)1 $1,275 $1,108 $927 $723 $268 2015 2016 2017 2018 2019 $1.2 $1.6 $1.1 $1.4 $1.2 2015 2016 2017 2018 2019 $311 $272 $175 $143 $110 2015 2016 2017 2018 2019 $2.1 $2.7 $3.0 $4.0 $3.9 2015 2016 2017 2018 2019

APPENDIX B

34 FORECAST ASSUMPTIONS Source: Landsea HomesManagement 3 Revenue No additional lot sales; however, depending on market conditions, we may find opportunities to buy a large master plan and sell lots as we’ve done in thepast 4 Cost of GoodsSold Specific to each community based on currentbudgets 5 Expenses Selling expenses are projected at each community and will vary as a percentage of revenue depending on internal commission rates, level of cobroker participation, local taxes and other marketing and advertising costs of eachcommunity G&A Expenses include expected costs to operate as a public company, including executive and boardcompensation 6 Liquidity Minimum cash balances between $50m -$60m Target debt-to-cap ratio of ~40%, but capacity to support a 50% debt-to-capratio We assumed a bond issuance to occur in 1Q2022 and the creation of an unsecured revolver to replace all existing debt 1 Overall Theme andStrategy Focus on entry-level homes, utilizing SPAC proceeds ($124m net proceeds from merger) to: Initially paydown debt until new M&A target is identified/under control Appropriately increase scale within our currentmarkets Manage to a 3-to 4-year lot supply based on LTM deliveries and expectation of no jointventures Wind down existing NYC positions (two assets) and redeploy that capital into newmarkets 2020P&Lcomessolelyfromcurrentcommunities;2021P&Lexpectedprimarily fromcommunitiesweownorcontroland$85mofrevenueand$8mofadjusted netincomefromaNewCoacquisition 2 NewMarkets Use large portion of transaction proceeds to acquire another builder in a new market Forecast assumes closing a transaction in 1Q2021 at a conservative multiple compared to Pinnacle West Homes and Garrett WalkerHomes Forecastassumesclosingonasecondbuilderin1Q2022

35 NEWYORKMETROASSETS Source: Landsea HomesManagement Note: 1) Preliminary estimates as of June 30,2020. Operating Metrics Community Location Total Units Units DeliveredLTD Backlog Unsold Units ASP$ TargetBuyer Status of Construction Type 14th and6th Avora NewYorkCity 50 Weehawken,NJ 184 0 130 0 3 50 51 $2.5 $1.2 Move-Up Move-Up Foundation Complete ConsolidatedJV UnconsolidatedJV $ inmillions Financial Metrics 1 Community LHI’s Total Debt Total Total Equity LHI PtrEquity Contribution% Assets Liability Equity 14th and6th 95% $78.4 $44.5 $46.9 $31.5 $29.9 $1.6 Avora 51% $62.4 $7.0 $12.8 $49.6 $25.3 $24.3

36 Source: Landsea Homes Management Note: 1) Historicals not pro forma foracquisitions. KEYOPERATINGMETRICS 1 Operating Metrics byQuarter New Home Orders(Units) Home Deliveries(Units) Backlog(Units) 278 270 237 147 108 64 Q220Q120 640 856 59 91 183 147 512 460 140 216 252 121 Q119 Q219 Q319 Q419 Q120 Q220 Q119 Q219 Q319 Q419 Q120 Q220 Q119 Q219 Q319 Q419

37 SUMMARYP&L Source: Landsea Homes Management Note: 1) Includes other expense (income) and JV income(loss). $ inmillions FYE12/31 2017 2018 2019 Net Orders(Units) 120 333 480 Home Deliveries(Units) 38 290 597 Backlog(Units) 101 145 121 ASP of Deliveries ($Thousands) $757 $1,199 $953 HomeSales $28.8 $347.8 $568.9 LotSales 168.6 30.8 62.1 TotalRevenue $197.3 $378.6 $631.0 Home SalesMargin 1.6 68.9 90.8 Lot SalesMargin 20.3 3.5 8.6 Total GrossMargin $21.9 $72.3 $99.5 Fully Adj. HomeGM% 19.3% 24.5% 23.6% SG&A 25.3 42.6 61.4 SG&A as a % of HomeSales 87.9% 12.2% 10.8% OperatingIncome ($3.4) $29.7 $38.1 Income/(Loss)Expense 1 3.2 11.6 (9.5) PretaxIncome ($0.1) $41.3 $28.6 Pretax Income% (0.1%) 10.9% 4.5% Tax Provision 0.2 4.6 6.2 Effective Tax Rate% NM 11.2% 21.6% NetIncome ($0.3) $36.7 $22.4 Net Income% (0.2%) 9.7% 3.5% Profit (Loss) to NoncontrolInterests 0.1 7.5 5.2 Net Income toLandsea ($0.4) $29.2 $17.2 OperatingEBITDA $5.1 $42.0 $73.9

38 HISTORICAL BALANCE SHEETDETAIL Source: Landsea HomesManagement Book Value($m) Real Estate Inventories($m) 5%9% 2017A 2017A2018A 2018A2019A 2019AQ12020 Q12020 $ 480 $ 533 $ 565 $ 554 $ 539 $ 647 $ 598 $ 702 CAGR CAGR Q22020 $ 505 Q22020 $ 730

39 Source:LandseaHomesManagementNotes:1)Assumes~48msharesatmerger(assumingnoredemptions,earnout,warrantdilutionoramendmenttothetermsofthepublicwarrants);adj.EPScalculatedusingadj.NI 2)Adj.ROEcalculatedusingadj.NI. SUPPLEMENTAL FINANCIALDISCLOSURE (Unaudited) Six Months Ended June30 Years Ended December31 ($ inthousands) 2019 2020 2017A 2018A 2019A 2020E 2021E 2022E HomeSales $184,680 $231,353 $28,753 $347,828 $568,872 $696,601 $882,561 $1,183,485 LotSales $37,172 $0 $168,553 $30,789 $62,116 $0 $0 $0 TotalRevenue $221,852 $231,353 $197,306 $378,617 $630,988 $696,601 $882,561 $1,183,485 %Growth n.a. 4.3% n.a. 92% 67% 10% 27% 34% Total GrossMargin $37,352 $22,910 $21,886 $72,313 $99,459 $95,857 $148,602 $209,851 Home Sales GM% 17.6% 9.9% 5.4% 19.8% 16.0% 13.8% 16.8% 17.7% Fully Adj. HomeGM% 23.8% 17.2% 19.3% 24.5% 23.6% 20.4% 21.4% 22.1% Lot Sales GM% 13.1% 0.0% 12.1% 11.2% 13.9% 0.0% 0.0% 0.0% SG&A $23,221 $37,568 $25,261 $42,579 $61,406 $85,431 $104,385 $121,001 SG&A as a % of HomeSales 12.6% 16.2% 87.9% 12.2% 10.8% 12.3% 11.8% 10.2% OperatingIncome $14,130 ($14,658) ($3,375) $29,734 $38,053 $10,426 $44,218 $88,850 Net Income toLandsea $3,305 ($22,483) ($413) $29,184 $17,200 $845 $33,265 $63,892 EBITDA $21,574 ($20,148) $4,688 $63,380 $73,851 $42,177 $80,362 $126,672 OperatingEBITDA $23,164 $4,299 $5,146 $41,967 $73,905 $61,934 $86,949 $138,276 Adjusted Net Income toLandsea $11,537 ($3,801) $1,845 $26,409 $36,223 $25,335 $43,546 $74,720 KPIs Net Orders(Units) 150 972 120 333 480 1,624 2,072 2,608 Net OrdersValue $175,200 $451,479 $148,000 $376,000 $462,400 $701,204 $817,161 $986,435 ASP of NetOrders $1,168K $464K $1,233K $1,129K $963K $432K $394K $378K Deliveries(Units) 172 507 38 289 597 1,462 1,979 2,657 ASP ofDeliveries $1,074K $456K $757K $1,204K $953K $476K $446K $445K Average ActiveCommunities 11 32 3 8 15 32 43 52 NetDebt $143,579 $243,439 $115,425 $132,956 $35,921 $45,103 $188,164 $307,815 Debt-to-Cap Ratio 21% 39% 22% 30% 25% 16% 26% 34% Net Debt-to-CapRatio 8% 32% 19% 17% 5% 6% 20% 27% Fully DilutedEPS 1 n.m. $0.60 $0.36 $0.02 $0.69 $1.32 Fully Diluted Adj.EPS 1 $0.04 $0.55 $0.75 $0.52 $0.90 $1.55 AbsorptionRate 2.3 5.0 3.4 3.7 2.7 3.9 4.0 4.2 AdjustedROE 2 0.4% 5.0% 6.4% 4.8% 7.8% 12.0%

40 ADJUSTED HOMEBUILDING GROSSMARGIN $ inmillions FYE12/31 2017 2018 2019 HomeSales $28.8 $347.8 $568.9 Home SalesCOGS (27.2) (279.0) (478.1) Home Sales GrossMargin $1.6 $68.9 $90.8 Margin% 5% 20% 16% Add: Intercompany Interest inCOGS 2.7 9.2 15.6 Add: Interest inCOGS 1.3 7.1 24.7 Add: Purch. Acctg. inCOGS - - 2.9 Fully Adj. Home Sales GrossMargin $5.5 $85.1 $134.1 Margin% 19% 24% 24% RECONCILIATIONS OFADJUSTEDMETRICS Source: Landsea HomesManagement

41 Source: Landsea HomesManagement Notes: 1) Imputed interest related to a land banking transaction that was treated as a product financingarrangement. OPERATING EBITDA $inmillions FYE12/31 2017 2018 2019 NetIncome $(0.3) $36.7 $22.4 Add: TaxProvision 0.2 4.6 6.2 PretaxIncome (0.1) 41.3 28.6 Add: Third-Party Interest inCOGS 2.0 7.2 24.7 Add: Interco. Interest inCOGS 2.7 9.2 15.6 Add: Interco. Int. Amort. toJVinc. - 4.1 1.9 Depreciation 0.2 1.6 3.0 EBITDA $4.7 $63.4 $73.9 Margin% 2% 17% 12% Add: Purch. Acctg. InCOGS - - 2.9 Add: (Profit)/Loss fromJVs 0.5 (17.1) 6.0 Add: TransactionCosts - - 1.2 Add: Impairment inCOGS - - - Less: Debt ForgivenessIncome - - - Less: Vale Imputed Int. inCOGS 1 - (4.3) (10.0) OperatingEBITDA $5.1 $42.0 $73.9 Margin% 3% 11% 12% RECONCILIATIONS OFADJUSTEDMETRICS CONT’D

42 Source: Landsea Homes Management Notes: 1) Intercompany interest pushed down by our parent 2) Purchase accounting adjustments from business combinations and acquiredinventory. ADJUSTED NETINCOME $inmillions FYE12/31 2018 2019 2020E 2021E 2022E Net Income (Loss)toLandsea $29.2 $17.2 $0.8 $33.3 $63.9 Add:Interco. Interest inCOGS 1 9.2 15.6 10.4 7.5 3.2 Add:Purch. Acctg. inCOGS 2 0.0 2.9 9.0 8.2 11.6 Add:(Profit)/Loss fromJV's (13.0) 7.9 14.2 (1.6) 0.0 TotalAdjustments (3.9) 26.4 33.5 14.1 14.8 Normalized Effective TaxRate 28% 28% 27% 27% 27% Tax-EffectedAdjustments (2.8) 19.0 24.5 10.3 10.8 Illustrative Adj. Net Income toLandsea $26.4 $36.2 $25.3 $43.5 $74.7 RECONCILIATIONS OFADJUSTEDMETRICS CONT’D